Sustainability Initiatives

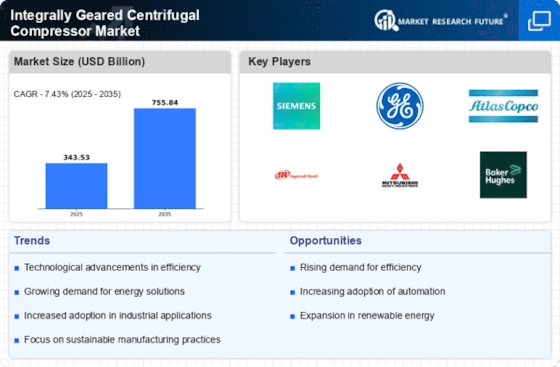

The Integrally Geared Centrifugal Compressor Market is increasingly influenced by sustainability initiatives. Companies are under pressure to reduce their carbon footprint and comply with stringent environmental regulations. Integrally geared centrifugal compressors, known for their lower emissions and energy-efficient operation, align well with these sustainability goals. The market is witnessing a shift towards compressors that not only perform efficiently but also contribute to environmental conservation. As industries adopt greener practices, the demand for these compressors is anticipated to grow, reflecting a broader trend towards sustainable industrial operations.

Rising Demand for Energy Efficiency

Energy efficiency is becoming a critical focus within the Integrally Geared Centrifugal Compressor Market. As energy costs continue to escalate, industries are compelled to adopt solutions that minimize energy consumption. Integrally geared centrifugal compressors are recognized for their ability to deliver high efficiency, often exceeding traditional compressor systems. Reports suggest that these compressors can achieve energy savings of up to 30%, making them an attractive option for sectors such as oil and gas, chemical processing, and power generation. This growing emphasis on energy efficiency is expected to drive market growth, as companies strive to reduce operational costs and meet regulatory requirements.

Technological Advancements in Design

The Integrally Geared Centrifugal Compressor Market is experiencing a surge in technological advancements that enhance efficiency and performance. Innovations in design, such as the integration of advanced materials and computational fluid dynamics, are leading to compressors that operate at higher efficiencies. For instance, the introduction of variable speed drives allows for better control over the compressor's operation, adapting to varying load conditions. This adaptability not only improves energy consumption but also extends the lifespan of the equipment. As industries increasingly seek to optimize their operations, the demand for these advanced compressors is likely to rise, indicating a robust growth trajectory for the market.

Customization and Application Versatility

Customization is a key driver in the Integrally Geared Centrifugal Compressor Market. Different industries have unique requirements, and the ability to tailor compressors to specific applications is becoming increasingly important. Manufacturers are responding by offering customizable solutions that cater to various operational needs, from high-pressure applications in petrochemicals to low-flow requirements in HVAC systems. This versatility not only enhances the performance of the compressors but also broadens their applicability across diverse sectors. As industries seek solutions that fit their specific operational parameters, the demand for customizable integrally geared centrifugal compressors is likely to increase.

Growth in Industrialization and Infrastructure Development

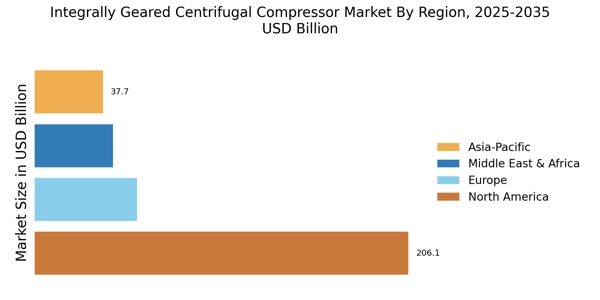

The Integrally Geared Centrifugal Compressor Market is poised for growth due to the ongoing industrialization and infrastructure development across various regions. As economies expand, there is a rising need for efficient and reliable compressor systems in sectors such as manufacturing, energy, and construction. The increasing investments in infrastructure projects, including power plants and industrial facilities, are driving the demand for high-performance compressors. Market analysis indicates that the growth in these sectors will likely propel the integrally geared centrifugal compressor market, as companies seek to enhance productivity and operational efficiency.

Leave a Comment