Increasing Focus on Sustainability

The Intermediate Bulk Container Liner Market is increasingly influenced by the growing focus on sustainability and eco-friendly practices. As businesses become more environmentally conscious, there is a rising demand for packaging solutions that minimize environmental impact. IBC liners made from recyclable materials are gaining popularity, as they align with corporate sustainability goals. Furthermore, the reduction of waste through the use of reusable liners is appealing to companies looking to enhance their green credentials. Market data suggests that the demand for sustainable packaging solutions is expected to rise significantly, with many companies committing to reducing their carbon footprint. This shift towards sustainability is likely to drive growth in the Intermediate Bulk Container Liner Market.

Rising Demand for Bulk Transportation

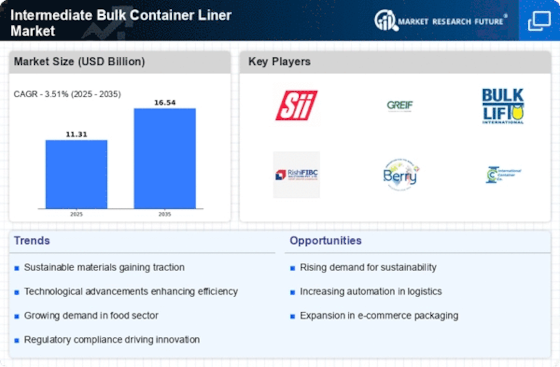

The Intermediate Bulk Container Liner Market is experiencing a notable increase in demand for bulk transportation solutions. This trend is driven by the growing need for efficient logistics in various sectors, including chemicals, food, and pharmaceuticals. As industries seek to optimize their supply chains, the use of intermediate bulk containers (IBCs) equipped with liners has become a preferred choice. According to recent data, the market for IBCs is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is indicative of the increasing reliance on bulk transportation methods, which are perceived as cost-effective and environmentally friendly. Consequently, the rising demand for bulk transportation is a significant driver for the Intermediate Bulk Container Liner Market.

Growth in E-commerce and Online Retail

The Intermediate Bulk Container Liner Market is poised to benefit from the rapid growth in e-commerce and online retail. As more businesses transition to online platforms, the need for efficient packaging solutions has become paramount. IBC liners offer a practical solution for transporting bulk goods, ensuring that products remain intact during transit. The e-commerce sector has seen exponential growth, with projections indicating that online sales could reach trillions of dollars in the coming years. This surge in e-commerce activities is expected to drive the demand for intermediate bulk containers, as retailers seek to streamline their logistics and reduce shipping costs. Thus, the growth in e-commerce is a pivotal driver for the Intermediate Bulk Container Liner Market.

Technological Innovations in Packaging

Technological innovations are reshaping the Intermediate Bulk Container Liner Market, as advancements in materials and design enhance the functionality of IBC liners. Innovations such as the development of multi-layered liners and biodegradable materials are gaining traction, catering to the evolving needs of various industries. These advancements not only improve the durability and safety of liners but also align with sustainability goals. The introduction of smart packaging technologies, which incorporate sensors and tracking systems, is also emerging as a trend. Such innovations are likely to attract more businesses to adopt IBC liners, as they offer improved efficiency and monitoring capabilities. Therefore, technological innovations represent a crucial driver for the Intermediate Bulk Container Liner Market.

Regulatory Compliance and Safety Standards

The Intermediate Bulk Container Liner Market is significantly influenced by stringent regulatory compliance and safety standards. Various sectors, particularly those dealing with hazardous materials, are subject to rigorous regulations that mandate the use of safe and reliable packaging solutions. The implementation of these regulations has led to an increased adoption of IBC liners, which provide enhanced protection against leaks and contamination. For instance, the European Union has established specific guidelines for the transportation of hazardous substances, which has propelled the demand for compliant packaging solutions. As companies strive to meet these safety standards, the Intermediate Bulk Container Liner Market is likely to witness sustained growth, as businesses prioritize safety and compliance in their operations.

.png)