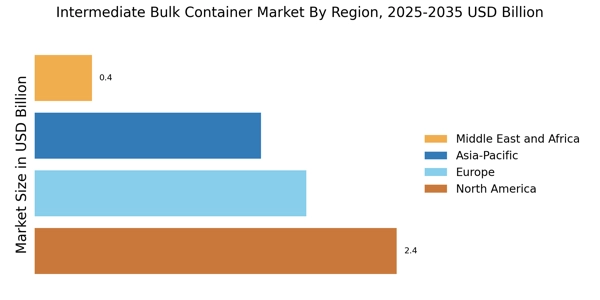

North America : Market Leader in Innovation

North America is the largest market for Intermediate Bulk Containers (IBCs), holding approximately 40% of the global market share. The region's growth is driven by the increasing demand from industries such as chemicals, food and beverage, and pharmaceuticals. Regulatory support for sustainable packaging solutions further catalyzes Intermediate Bulk Container Market expansion, with initiatives aimed at reducing plastic waste and promoting recycling.

The United States and Canada are the leading countries in this region, with major players like Mauser Packaging Solutions and Greif, Inc. dominating the landscape. The competitive environment is characterized by innovation in container design and materials, as companies strive to meet stringent safety and environmental regulations. The presence of established manufacturers ensures a robust supply chain and distribution network, enhancing Intermediate Bulk Container Market accessibility.

Europe : Sustainable Packaging Initiatives

Europe is witnessing significant growth in the Intermediate Bulk Container Market, accounting for approximately 30% of the global share. The region's demand is primarily driven by stringent regulations on packaging waste and a strong push towards sustainable practices. Countries like Germany and France are at the forefront, implementing policies that encourage the use of eco-friendly materials and recycling initiatives, which are pivotal for Intermediate Bulk Container Market growth.

Germany, the largest market in Europe, is home to key players such as Thielmann and Auer Packaging GmbH. The competitive landscape is marked by innovation and collaboration among manufacturers to develop advanced IBC solutions that meet regulatory standards. The presence of a well-established logistics network further supports the distribution of IBCs across various industries, including chemicals and food processing.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is emerging as a significant player in the Intermediate Bulk Container Market, holding around 25% of the global market share. The rapid industrialization and urbanization in countries like China and India are key drivers of this growth. Additionally, the increasing demand for bulk packaging solutions in the food and beverage sector is propelling Intermediate Bulk Container Market expansion, supported by favorable government policies promoting manufacturing and trade.

China is the largest market in the region, with a growing number of local manufacturers entering the IBC market. The competitive landscape is evolving, with both domestic and international players striving to capture market share. Companies like Schutz Container Systems are expanding their operations to meet the rising demand, while local firms are focusing on cost-effective solutions to cater to various industries, including agriculture and chemicals.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually developing its Intermediate Bulk Container Market, currently holding about 5% of the global share. The growth is primarily driven by increasing investments in infrastructure and the oil and gas sector, which require efficient bulk packaging solutions. Countries like the UAE and South Africa are leading the charge, with government initiatives aimed at enhancing industrial capabilities and attracting foreign investment. The competitive landscape is still in its nascent stages, with a mix of local and international players. Companies are focusing on establishing manufacturing facilities to cater to the growing demand for IBCs in various sectors, including chemicals and food processing. The presence of key players like Berry Global, Inc. is expected to stimulate market growth as they expand their operations in the region.