Increasing Prevalence of Spinal Disorders

The rising incidence of spinal disorders, particularly among the aging population, is a significant driver for the Interspinous Spacer Market. Conditions such as degenerative disc disease and spinal stenosis are becoming more prevalent, leading to a higher demand for effective treatment options. According to recent data, approximately 80% of individuals experience back pain at some point in their lives, with a notable percentage requiring surgical intervention. This trend is expected to continue, as the population ages and lifestyle factors contribute to spinal health issues. Consequently, the Interspinous Spacer Market is poised for growth, as healthcare providers seek innovative solutions to address these challenges and improve patient quality of life.

Regulatory Support and Approval for New Devices

Regulatory support plays a pivotal role in shaping the Interspinous Spacer Market. The approval of new interspinous spacer devices by regulatory bodies is essential for market entry and acceptance. Recent trends indicate that regulatory agencies are streamlining the approval process for innovative spinal devices, which may encourage manufacturers to invest in new product development. This supportive environment is likely to lead to a wider array of options for healthcare providers and patients, ultimately enhancing treatment outcomes. As more devices gain approval, the Interspinous Spacer Market is expected to witness increased competition and growth, as well as improved patient access to advanced spinal care solutions.

Technological Innovations in Interspinous Spacer Market

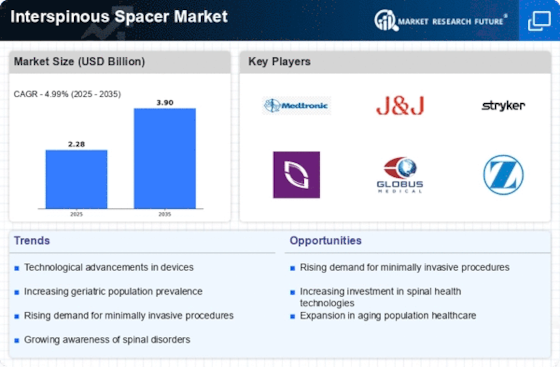

The Interspinous Spacer Market is experiencing a surge in technological innovations that enhance the efficacy and safety of spinal surgeries. Advanced materials and design improvements are leading to the development of more effective interspinous spacers, which are crucial for patients suffering from spinal stenosis and other related disorders. For instance, the introduction of bioresorbable materials is gaining traction, potentially reducing the need for subsequent surgeries. Furthermore, the integration of imaging technologies, such as intraoperative CT scans, allows for precise placement of these devices, thereby improving patient outcomes. As these technologies evolve, they are likely to drive growth in the Interspinous Spacer Market, with projections indicating a compound annual growth rate of around 8% over the next few years.

Growing Investment in Spine Surgery Research and Development

Investment in research and development within the spine surgery sector is a crucial driver for the Interspinous Spacer Market. Increased funding from both public and private sectors is facilitating the exploration of new materials, designs, and surgical techniques. This focus on innovation is expected to yield advanced interspinous spacers that offer improved performance and patient outcomes. Furthermore, collaborations between medical device companies and research institutions are fostering the development of cutting-edge solutions tailored to specific spinal conditions. As the market evolves, the influx of new products and technologies is likely to stimulate competition and drive growth within the Interspinous Spacer Market.

Rising Preference for Minimally Invasive Surgical Techniques

The shift towards minimally invasive surgical techniques is significantly influencing the Interspinous Spacer Market. Patients and healthcare professionals alike are increasingly favoring procedures that minimize recovery time and reduce postoperative complications. Interspinous spacers, designed for less invasive implantation, align well with this trend, offering an alternative to traditional spinal fusion surgeries. Market data suggests that minimally invasive procedures are projected to account for over 60% of spinal surgeries in the coming years. This preference not only enhances patient satisfaction but also reduces healthcare costs associated with longer hospital stays and rehabilitation. As a result, the Interspinous Spacer Market is likely to expand as more practitioners adopt these techniques.

.png)