Rising Demand for Enhanced Oil Recovery

The oilwell spacer-fluid market is experiencing a notable increase in demand due to the rising focus on enhanced oil recovery (EOR) techniques. As conventional oil reserves deplete, operators are increasingly turning to EOR methods, which often require specialized spacer fluids to optimize the extraction process. This trend is particularly evident in the US, where the EOR market is projected to grow at a CAGR of approximately 8% over the next five years. The use of spacer fluids in EOR applications not only improves the efficiency of oil extraction but also minimizes the environmental impact, aligning with industry sustainability goals. Consequently, The oilwell spacer-fluid market is likely to benefit from this shift. Companies are seeking to invest in advanced fluid technologies that enhance recovery rates while adhering to regulatory standards.

Expansion of Offshore Drilling Operations

The oilwell spacer-fluid market is likely to benefit from the expansion of offshore drilling operations in the US. As energy companies explore deeper waters and more challenging environments, the demand for specialized spacer fluids that can perform under high pressure and temperature conditions is increasing. Recent reports indicate that offshore drilling activities are projected to grow by approximately 10% over the next few years, driven by advancements in drilling technology and the need for energy diversification. This growth presents opportunities for the oilwell spacer-fluid market, as operators require high-quality fluids that ensure wellbore stability and effective fluid displacement. Consequently, the market is expected to see a rise in demand for innovative spacer fluid solutions tailored to the unique challenges of offshore drilling.

Growing Focus on Environmental Regulations

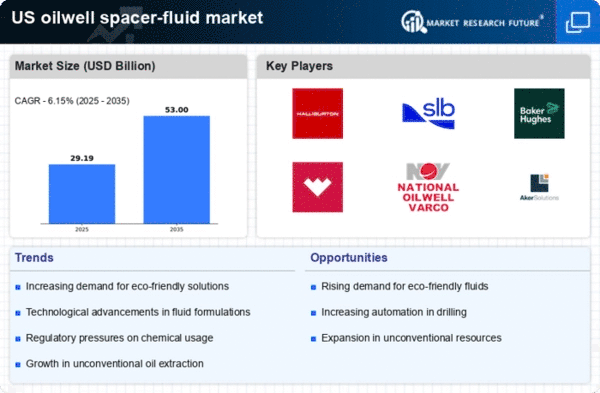

The oilwell spacer-fluid market is being shaped by an increasing emphasis on environmental regulations and sustainability practices. In the US, regulatory bodies are implementing stricter guidelines regarding the use of chemicals in drilling fluids, prompting operators to seek eco-friendly alternatives. This shift is driving innovation within the oilwell spacer-fluid market, as companies strive to develop formulations that comply with environmental standards while maintaining performance. The market for biodegradable and non-toxic spacer fluids is expected to expand, as operators prioritize sustainability in their operations. This trend indicates a potential transformation in the oilwell spacer-fluid market, as the industry adapts to meet regulatory requirements and societal expectations for environmentally responsible practices.

Technological Innovations in Fluid Formulations

The oilwell spacer-fluid market is witnessing a wave of technological innovations aimed at improving fluid formulations. Advances in chemical engineering and material science have led to the development of novel spacer fluids that offer enhanced performance characteristics, such as improved viscosity, thermal stability, and environmental compatibility. These innovations are particularly relevant in the US market, where operators are increasingly seeking fluids that can withstand extreme conditions encountered during drilling and completion operations. The introduction of smart fluids, which can adapt their properties in response to changing downhole conditions, is also gaining traction. This trend suggests that the oilwell spacer-fluid market will continue to evolve, as companies invest in research and development to create cutting-edge fluid solutions that meet the demands of modern drilling practices.

Increased Drilling Activities in Unconventional Resources

The oilwell spacer-fluid market is significantly influenced by the surge in drilling activities targeting unconventional resources such as shale oil and gas. The US has witnessed a remarkable increase in hydraulic fracturing operations, which necessitate the use of effective spacer fluids to ensure optimal wellbore integrity and fluid displacement. According to recent estimates, the number of active drilling rigs in the US has risen by over 15% in the past year, reflecting a robust recovery in exploration and production activities. This uptick in drilling operations is expected to drive the demand for high-performance spacer fluids, as operators prioritize efficiency and safety in their drilling programs. As a result, the oilwell spacer-fluid market is poised for growth, driven by the need for innovative fluid solutions that cater to the complexities of unconventional resource extraction.