Global Food Security Concerns

Concerns regarding food security are increasingly influencing the IPM Pheromone Products Market. As the global population continues to rise, the demand for food production intensifies, necessitating effective pest management solutions to ensure crop yields. Pheromone products, as part of IPM strategies, offer a sustainable approach to pest control that minimizes crop losses. Market projections indicate that the need for enhanced food production methods will drive the adoption of IPM pheromone products, as they provide a viable alternative to chemical pesticides. This focus on food security is likely to propel the market forward, as stakeholders seek to balance productivity with environmental sustainability.

Rising Demand for Organic Produce

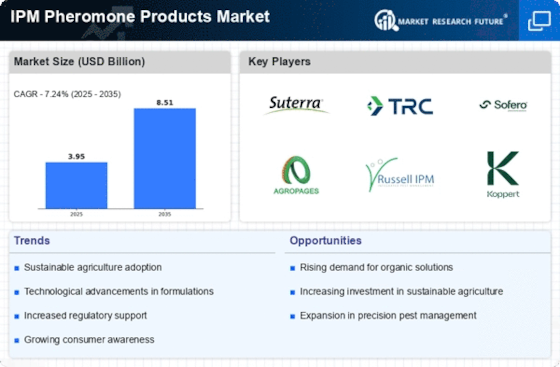

The increasing consumer preference for organic produce is a pivotal driver for the IPM Pheromone Products Market. As consumers become more health-conscious, the demand for food free from synthetic pesticides has surged. This trend is reflected in market data, indicating that organic food sales have seen a steady growth rate of approximately 10% annually. Consequently, farmers are increasingly adopting Integrated Pest Management (IPM) strategies that utilize pheromone products to manage pests effectively while adhering to organic standards. This shift not only enhances crop yield but also aligns with the growing consumer demand for sustainable agricultural practices, thereby propelling the IPM Pheromone Products Market forward.

Increased Awareness of Pest Resistance

The growing awareness of pest resistance to conventional pesticides is a critical driver for the IPM Pheromone Products Market. Farmers are increasingly recognizing that reliance on chemical pesticides can lead to resistant pest populations, which complicates pest management efforts. This awareness is prompting a shift towards alternative solutions, such as pheromone products, which disrupt pest mating and reduce population growth without contributing to resistance. As a result, the market for IPM pheromone products is likely to expand, as farmers seek effective strategies to manage pests sustainably. This trend underscores the importance of integrating pheromone products into pest management programs to mitigate resistance issues.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainable agricultural practices are significantly influencing the IPM Pheromone Products Market. Many countries have implemented policies aimed at reducing chemical pesticide usage, thereby encouraging farmers to adopt environmentally friendly pest management solutions. For instance, regulations in various regions mandate the use of IPM techniques, which include pheromone-based products, as part of their agricultural frameworks. This regulatory support is expected to bolster the market, as it incentivizes farmers to transition towards more sustainable practices. The market is projected to grow as these regulations become more stringent, creating a favorable environment for the adoption of IPM pheromone products.

Technological Innovations in Pheromone Delivery Systems

Technological advancements in pheromone delivery systems are driving growth in the IPM Pheromone Products Market. Innovations such as controlled-release formulations and automated dispensers enhance the efficacy and efficiency of pheromone applications. These technologies allow for precise targeting of pests, reducing waste and improving pest control outcomes. Market data suggests that the introduction of these advanced delivery systems could increase the adoption rate of pheromone products among farmers, as they offer a more effective solution compared to traditional methods. As technology continues to evolve, it is likely that the IPM Pheromone Products Market will experience significant growth, driven by these innovations.