Research Methodology on IR Spectroscopy Market

Introduction

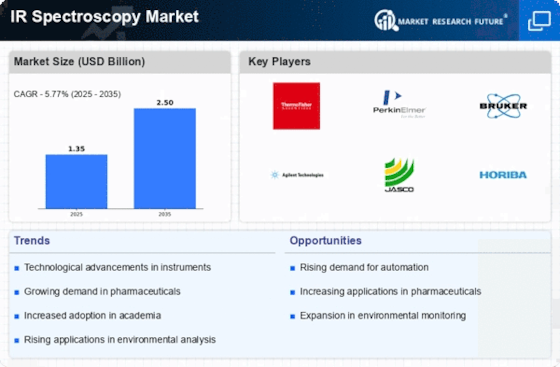

The Market Research Future (MRFR) report provides an extensive and in-depth analysis of the global IR spectroscopy market including drivers, trends, opportunities, and restraints. This report delivers an overall outlook on the global IR spectroscopy market as well as sheds light on the existing information concerning the market and its current trends. The report forecasts the market's performance over the review period (2023-2030). This report considers the revenue generated from the sale of IR spectroscopy hardware and services.

Research Methodology

This report uses a combination of primary and secondary research methods to frame market estimations and forecast market growth. The primary research method utilized was semi-structured interviews with industry experts and industry professionals. These interviews help in understanding the nature of the market as well as the existing trends in the market. The secondary research method typically consists of a comprehensive study of the data obtained from various sources including company websites, databases, industry studies, peer-reviewed articles, and financial studies.

The data for this report has been collected from both primary and secondary resources. The primary sources include interviews with industry experts and industry professionals from key market participants in the industry. The secondary sources include official government publications, trade publications, financial documents, annual reports and webcasts of industry conferences and white papers.

The scope of the study covers the market to a granular level and provides estimates of current market performance and predictions of future market performance. The report provides a market estimation of the value of the global IR Spectroscopy market for the year 2023-2030. In order to do so, the report analyzes the various market dynamics, such as drivers, restraints, trends, and opportunities, and further evaluates their impact on the growth of the market over the forecast period.

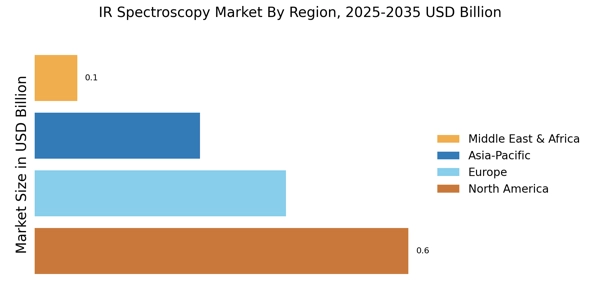

The report is further segregated based on product, end-user, application, and region. This report includes information on each market segment regarding their size, share, growth status, and future estimations. The data points are collected from various sources and the primary sources include the factories, service providers, vendors and distributorsofIR Spectroscopy products. Additionally, the report offers an analysis of the market competitiveness, global and regional segmentation, and technology trends, which are transforming the global IR Spectroscopy market.

In order to provide a comprehensive forecast of the global IR Spectroscopy market, this report utilized a number of statistical models and software tools. These include econometric forecasting software, system dynamics modelling software and internal Excel-based models. The dynamic model provides the basis for the estimation of future growth rates and the econometric model instead provides information on macroeconomic and industry growth factors that can potentially affect the market. The Excel-based models have been used to refer to specific scenarios, local market implications, and segmental representations. In addition, sensitivity analysis was conducted to test the micro and macroeconomic indicators of the market.

Conclusion

The report provides a detailed assessment of the global IR Spectroscopy market including key market segments, current trends, market drivers, restraints, and opportunities. Further, the report also covers a detailed analysis of the competitive landscape, product positioning, analysis of market dynamics, and the future growth prospects of the global IR Spectroscopy market over the forecast period 2023 to 2030. By incorporating qualitative and quantitative analysis from primary and secondary research, estimates of market growth are established.

The report is expected to serve as a reliable source of information on the global IR Spectroscopy market and provide comprehensive insights into the current and growth trends. In addition, the report can serve as a valuable resource for market participants to gain insight into the competitive landscape of the market and map strategic solutions to a better position in the global IR Spectroscopy market.