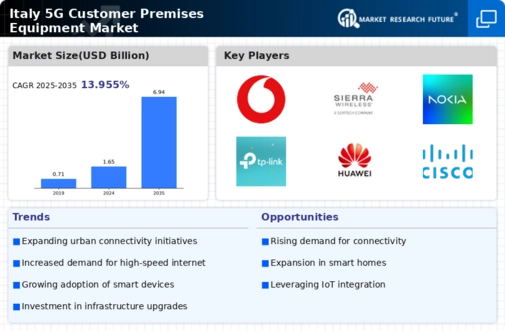

The 5g customer-premises-equipment market in Italy is characterized by a dynamic competitive landscape, driven by rapid technological advancements and increasing demand for high-speed connectivity. Major players such as Huawei (CN), Nokia (FI), and Ericsson (SE) are at the forefront, each adopting distinct strategies to enhance their market presence. Huawei (CN) focuses on innovation and R&D, investing heavily in next-generation technologies, while Nokia (FI) emphasizes strategic partnerships and regional expansion to bolster its service offerings. Ericsson (SE) appears to be concentrating on digital transformation initiatives, aiming to integrate AI and automation into its solutions, thereby enhancing operational efficiency and customer experience. Collectively, these strategies contribute to a competitive environment that is both collaborative and competitive, as companies seek to differentiate themselves through technological prowess and service excellence.

Key business tactics within this market include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The competitive structure is moderately fragmented, with several key players vying for market share. This fragmentation allows for a diverse range of offerings, yet the influence of major companies remains substantial, as they set industry standards and drive innovation. The interplay between established firms and emerging players creates a dynamic atmosphere, where agility and adaptability are crucial for success.

In October 2025, Nokia (FI) announced a strategic partnership with a leading Italian telecommunications provider to deploy advanced 5g solutions across urban areas. This collaboration is expected to enhance network performance and expand coverage, reflecting Nokia's commitment to regional expansion and customer-centric solutions. The partnership not only strengthens Nokia's foothold in Italy but also aligns with broader trends of enhancing urban connectivity through innovative technologies.

In September 2025, Ericsson (SE) unveiled a new AI-driven network management system designed to optimize 5g performance in real-time. This initiative underscores Ericsson's focus on digital transformation and its intent to leverage AI for improved operational efficiency. By integrating AI capabilities, Ericsson aims to provide its clients with enhanced network reliability and performance, which is increasingly critical in a competitive landscape where service quality is paramount.

In August 2025, Huawei (CN) launched a new line of 5g customer-premises equipment tailored for small and medium-sized enterprises (SMEs) in Italy. This move appears to be a strategic effort to penetrate the SME market, which has been historically underserved in terms of advanced connectivity solutions. By offering tailored products, Huawei aims to capture a significant share of this segment, thereby diversifying its customer base and enhancing its competitive positioning.

As of November 2025, current trends in the 5g customer-premises-equipment market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and expanding market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancement, and supply chain reliability. This shift suggests that companies will need to invest in R&D and forge strategic partnerships to remain competitive in an ever-evolving landscape.

Leave a Comment