Growing Regulatory Pressures

The asset performance-management market in Italy is increasingly shaped by growing regulatory pressures. As environmental and safety regulations become more stringent, organizations are compelled to adopt asset management practices that ensure compliance. This is particularly relevant in industries such as energy and manufacturing, where non-compliance can result in hefty fines and reputational damage. Companies are investing in asset performance-management solutions that not only enhance operational efficiency but also facilitate compliance with regulatory standards. The market is expected to expand as businesses seek to mitigate risks associated with regulatory non-compliance. Furthermore, the integration of compliance features into asset management systems is becoming a key selling point, indicating a shift towards more responsible asset management practices.

Shift Towards Sustainable Practices

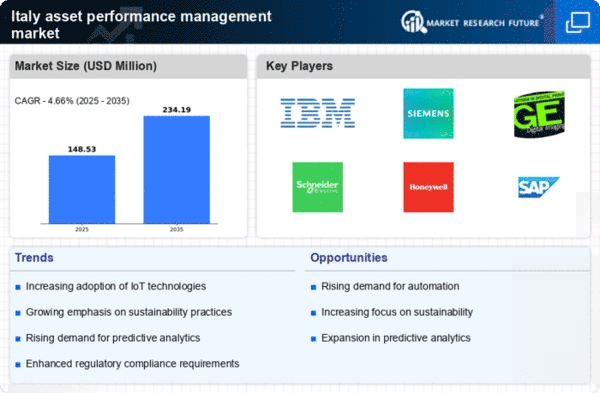

In Italy, the asset performance-management market is increasingly influenced by a shift towards sustainable practices. Organizations are recognizing the importance of sustainability in their operations, leading to a growing demand for asset management solutions that support environmentally friendly practices. This trend is particularly evident in sectors such as construction and transportation, where sustainable asset management can significantly reduce environmental impact. Companies are adopting strategies that not only enhance asset performance but also align with sustainability goals. The market is projected to grow as businesses seek to implement practices that contribute to sustainability while maintaining profitability. This dual focus on performance and sustainability is likely to drive innovation within the asset performance-management market, fostering the development of solutions that meet both operational and environmental objectives.

Rising Demand for Operational Efficiency

In Italy, the asset performance-management market is significantly influenced by the growing demand for operational efficiency across various industries. Organizations are under pressure to maximize asset utilization while minimizing costs. This trend is particularly evident in sectors such as transportation and utilities, where asset performance directly impacts service delivery and profitability. According to recent studies, companies that implement effective asset management strategies can achieve up to 20% reduction in operational costs. This drive for efficiency is prompting businesses to adopt sophisticated asset performance-management solutions that provide insights into asset health and performance. Consequently, the market is expected to expand as more organizations recognize the value of investing in systems that enhance operational efficiency and drive competitive advantage.

Increased Focus on Data-Driven Decision Making

The asset performance-management market in Italy is witnessing a paradigm shift towards data-driven decision making. Organizations are increasingly leveraging data analytics to inform their asset management strategies. This trend is fueled by the availability of vast amounts of data generated from various sources, including IoT devices and enterprise systems. By harnessing this data, companies can gain valuable insights into asset performance, leading to more informed decisions. The market is projected to grow as businesses recognize the importance of data in optimizing asset performance. In fact, studies indicate that organizations utilizing data analytics in asset management can improve decision-making speed by up to 30%. This shift towards data-centric approaches is likely to redefine the asset performance-management market, making it more competitive and efficient.

Technological Advancements in Asset Management

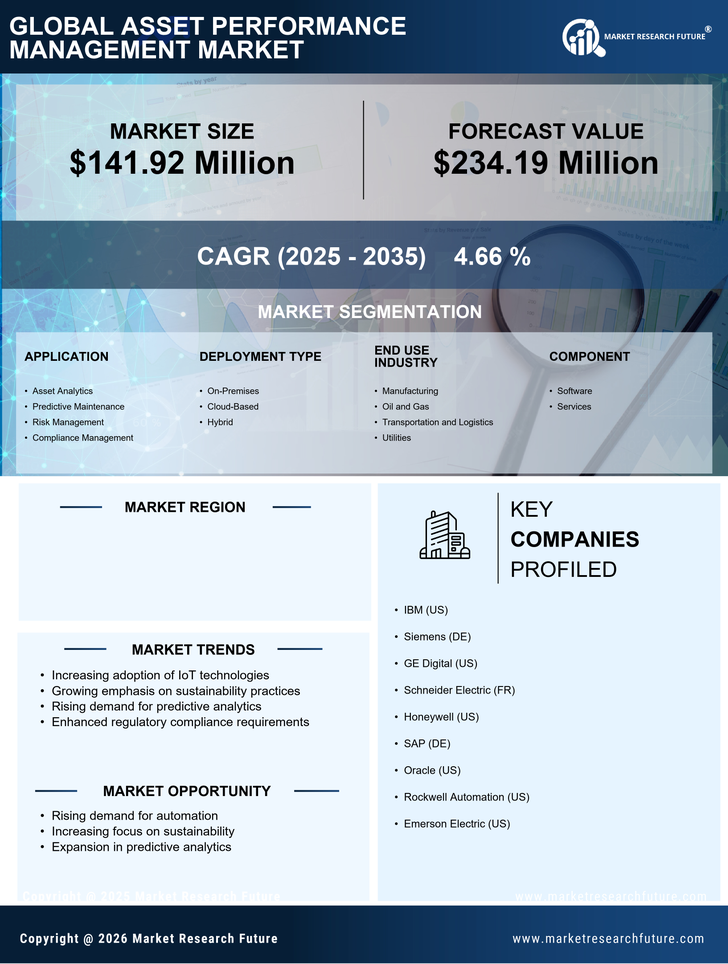

The asset performance-management market in Italy is experiencing a surge due to rapid technological advancements. Innovations in software and hardware are enhancing the capabilities of asset management systems. For instance, the integration of advanced analytics and machine learning algorithms allows for real-time monitoring and predictive insights. This is particularly relevant in sectors such as manufacturing and energy, where operational efficiency is paramount. The market is projected to grow at a CAGR of 8.5% from 2025 to 2030, driven by these technological improvements. Companies are increasingly investing in digital solutions to optimize asset utilization and reduce downtime, thereby improving overall productivity. As a result, the asset performance-management market is likely to see a significant transformation, with technology playing a central role in shaping its future.