Increasing Security Concerns

The rise in security threats, particularly in urban areas, has propelled the demand for counter uas market solutions in Italy. With incidents involving unauthorized drone flights over sensitive locations, such as government buildings and public events, the need for effective countermeasures has become paramount. The Italian government has recognized these threats, leading to increased funding for security initiatives. In 2025, the counter uas market is projected to grow by approximately 15%, driven by the urgency to protect critical infrastructure. This growth reflects a broader trend where security agencies are investing in advanced technologies to mitigate risks associated with drone usage. As a result, the counter uas market is likely to see a surge in innovative solutions aimed at addressing these pressing security challenges.

Rising Commercial Drone Usage

The proliferation of commercial drones across various sectors in Italy is a significant driver for the counter uas market. Industries such as agriculture, logistics, and media are increasingly adopting drone technology for operational efficiency. However, this surge in usage also raises concerns regarding safety and privacy, prompting a need for countermeasures. In 2025, the counter uas market is projected to expand by 14% as businesses seek to protect their assets from potential drone-related threats. The counter uas market is responding by developing tailored solutions that address the unique challenges posed by commercial drone operations. This trend suggests a growing awareness among businesses about the importance of safeguarding their operations against unauthorized drone activities.

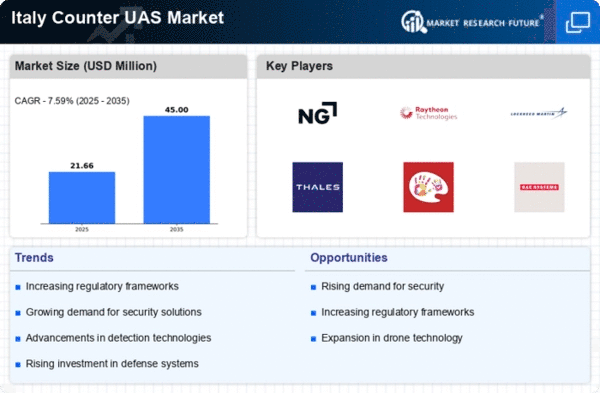

Regulatory Framework Enhancements

The establishment of a robust regulatory framework is crucial for the growth of the counter uas market in Italy. Recent legislative measures aimed at drone operations have created a structured environment for the deployment of countermeasures. In 2025, the Italian government is expected to implement stricter regulations governing drone usage, which may lead to a 10% increase in demand for counter uas solutions. This regulatory clarity not only fosters innovation but also encourages investment in the counter uas market. Companies are likely to develop compliant technologies that align with these regulations, ensuring that security measures are both effective and lawful. As a result, the market is poised for growth, driven by the need for adherence to evolving legal standards.

Technological Innovations in Defense

Technological advancements in defense systems are significantly influencing the counter uas market in Italy. The integration of artificial intelligence (AI) and machine learning into counter-drone systems enhances detection and neutralization capabilities. In 2025, the market is expected to witness a growth rate of around 12%, as defense contractors and technology firms collaborate to develop sophisticated solutions. These innovations not only improve operational efficiency but also reduce response times during potential threats. The counter uas market is thus evolving rapidly, with a focus on creating systems that can adapt to various operational environments. This trend indicates a shift towards more automated and intelligent defense mechanisms, which could redefine how security is managed in Italy.

Public Awareness and Demand for Safety

Public awareness regarding the risks associated with drones is on the rise in Italy, influencing the counter uas market. As citizens become more informed about potential threats, there is an increasing demand for safety measures to protect public spaces. In 2025, surveys indicate that approximately 70% of the population supports enhanced security measures against unauthorized drone activities. This heightened awareness is likely to drive investments in the counter uas market, as local governments and private entities seek to implement effective solutions. The market may experience a growth rate of around 11% as stakeholders respond to public concerns, leading to the development of community-focused counter uas initiatives. This trend underscores the importance of aligning security measures with public sentiment.