Increased Healthcare Expenditure

The rise in healthcare expenditure in Italy is a crucial factor influencing the endoscopic retrograde-cholangiopancreatography market. With the Italian government allocating approximately €150 billion annually to healthcare, there is a growing focus on improving diagnostic and therapeutic services. This financial commitment enables hospitals to upgrade their facilities and invest in advanced endoscopic technologies. As a result, the availability of endoscopic retrograde-cholangiopancreatography procedures is expanding, making them more accessible to patients. Furthermore, increased funding for research and development in medical technologies is likely to foster innovation, further driving the market. The emphasis on quality healthcare services aligns with the growing demand for effective treatment options, thereby supporting market growth.

Supportive Regulatory Environment

The regulatory landscape in Italy is becoming increasingly supportive of advanced medical procedures, including endoscopic retrograde-cholangiopancreatography. Regulatory bodies are streamlining approval processes for new technologies and procedures, which is likely to enhance market growth. The Italian Medicines Agency (AIFA) has been actively working to ensure that innovative medical devices meet safety and efficacy standards, thereby fostering a conducive environment for market expansion. This supportive regulatory framework encourages manufacturers to invest in research and development, leading to the introduction of new and improved endoscopic technologies. As regulations evolve to accommodate advancements in medical practices, the endoscopic retrograde-cholangiopancreatography market is expected to benefit from increased innovation and accessibility.

Advancements in Endoscopic Technology

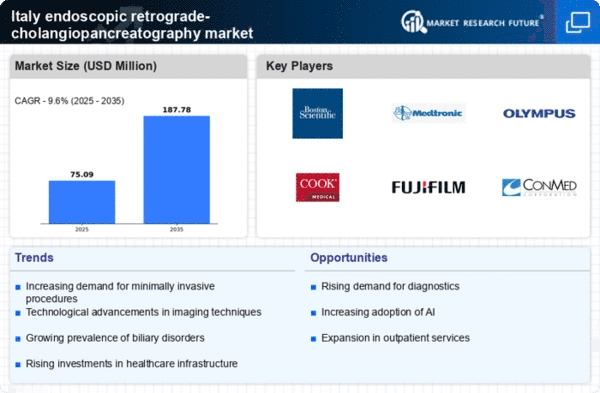

Technological innovations in endoscopic equipment are propelling the endoscopic retrograde-cholangiopancreatography market forward. The introduction of high-definition imaging, improved endoscopes, and advanced accessories enhances the precision and safety of procedures. In Italy, the market for endoscopic devices is expected to grow at a CAGR of around 6% over the next five years, driven by these advancements. Enhanced visualization and minimally invasive techniques reduce patient recovery time and hospital stays, making these procedures more appealing to both patients and healthcare providers. As hospitals and clinics invest in state-of-the-art technology, the demand for endoscopic retrograde-cholangiopancreatography is likely to rise, reflecting a shift towards more efficient and effective healthcare solutions.

Rising Incidence of Biliary Disorders

The increasing prevalence of biliary disorders in Italy is a significant driver for the endoscopic retrograde-cholangiopancreatography market. Conditions such as gallstones, cholangitis, and pancreatitis are becoming more common, leading to a higher demand for diagnostic and therapeutic procedures. According to recent health statistics, biliary disorders affect approximately 10-15% of the population, which translates to millions of potential patients requiring endoscopic interventions. This growing patient base is likely to stimulate the market, as healthcare providers seek effective solutions to manage these conditions. Furthermore, the aging population in Italy, which is projected to reach 23% by 2030, may further exacerbate the incidence of these disorders, thereby increasing the demand for endoscopic retrograde-cholangiopancreatography procedures.

Rising Awareness of Gastrointestinal Health

There is a notable increase in public awareness regarding gastrointestinal health in Italy, which is positively impacting the endoscopic retrograde-cholangiopancreatography market. Educational campaigns and health initiatives are encouraging individuals to seek early diagnosis and treatment for biliary and pancreatic disorders. This heightened awareness is likely to lead to an increase in the number of patients opting for endoscopic procedures, as they become more informed about their health options. Additionally, the collaboration between healthcare providers and community organizations to promote gastrointestinal health is expected to further drive demand. As more individuals recognize the importance of addressing gastrointestinal issues promptly, the market for endoscopic retrograde-cholangiopancreatography is poised for growth.