Aging Population

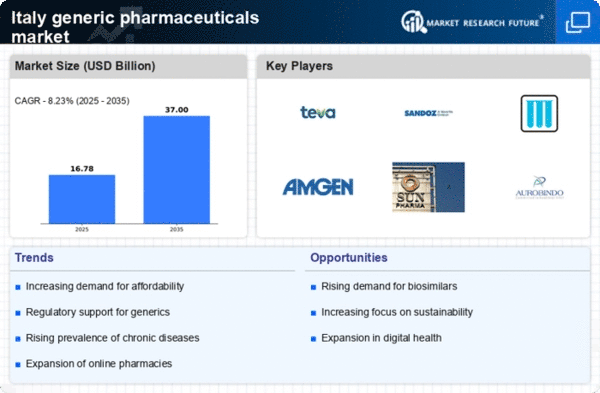

Italy's demographic shift towards an aging population is a crucial driver for the generic pharmaceuticals market. With approximately 23% of the population aged 65 and older, the demand for medications, particularly for chronic conditions, is on the rise. Older adults often require multiple prescriptions, leading to higher healthcare costs. The generic pharmaceuticals market stands to benefit from this trend, as generics provide a more affordable option for managing long-term health issues. In 2025, it is estimated that the market for generic medications could grow by 15% due to the increasing prevalence of age-related diseases, thus highlighting the importance of generics in the healthcare landscape.

Rising Healthcare Costs

The escalating costs associated with healthcare in Italy are driving the demand for the generic pharmaceuticals market. As patients and healthcare providers seek cost-effective alternatives to branded medications, the market for generics is likely to expand. In 2024, the Italian healthcare expenditure reached approximately €200 billion, with a significant portion allocated to pharmaceuticals. The generic pharmaceuticals market is positioned to capture a larger share of this expenditure. Generics typically offer savings of 30-80% compared to their branded counterparts. This trend suggests that as healthcare costs continue to rise, the reliance on generic medications will likely increase, thereby bolstering the market's growth.

Government Initiatives and Policies

The Italian government has implemented various initiatives aimed at promoting the use of generic medications, which significantly impacts the generic pharmaceuticals market. Policies encouraging the substitution of branded drugs with generics have been established to reduce healthcare spending. For instance, the Italian Medicines Agency (AIFA) has introduced measures to incentivize pharmacists to dispense generics, which has led to a reported increase in generic prescriptions by 25% over the past two years. Such government support not only enhances the accessibility of generics but also fosters a competitive environment that benefits consumers, thereby driving the market's growth.

Increased Awareness Among Consumers

There is a growing awareness among Italian consumers regarding the benefits of generic medications, which serves as a vital driver for the generic pharmaceuticals market. Educational campaigns and healthcare provider recommendations have contributed to a shift in perception, with many patients now recognizing that generics are equally effective as their branded counterparts. This increased awareness is reflected in the rising market share of generics, which accounted for approximately 40% of total pharmaceutical sales in 2025. As consumers continue to prioritize cost savings without compromising quality, the demand for generics is expected to further escalate, positively influencing the market.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of generic medications are significantly impacting the generic pharmaceuticals market. Innovations such as automated production lines and improved quality control systems have enhanced the efficiency and reliability of generic drug production. In Italy, the adoption of these technologies has led to a reduction in production costs by approximately 20%, allowing manufacturers to offer competitive pricing. As a result, the market is likely to experience growth as companies leverage these advancements to increase output and meet the rising demand for affordable medications. This trend indicates a promising future for the generic pharmaceuticals market as technology continues to evolve.