Healthcare Policy Reforms

Healthcare policy reforms in Italy are likely to impact the pain relief-medication market significantly. Recent changes in regulations and reimbursement policies may facilitate easier access to pain relief medications for patients. For instance, the Italian government has been working on initiatives to streamline the approval process for new medications, which could lead to a quicker introduction of innovative pain relief solutions. Additionally, reforms aimed at reducing out-of-pocket expenses for patients may encourage more individuals to seek treatment for their pain conditions. This evolving landscape suggests that the pain relief-medication market could experience growth as barriers to access are lowered, ultimately benefiting patients in need of effective pain management.

Increasing Aging Population

The increasing aging population in Italy appears to be a significant driver for the pain relief-medication market. As individuals age, they often experience chronic pain conditions such as arthritis and back pain, leading to a higher demand for effective pain relief solutions. According to recent statistics, approximately 23% of the Italian population is aged 65 and older, a demographic that is likely to require more pain management options. This trend suggests that pharmaceutical companies may focus on developing targeted medications to cater to the specific needs of older adults. Furthermore, the pain relief-medication market may see a shift towards formulations that are easier to administer and have fewer side effects, enhancing patient compliance and overall satisfaction.

Rising Awareness of Pain Management

There is a growing awareness of pain management strategies among the Italian population, which is likely to influence the pain relief-medication market. Educational campaigns and healthcare initiatives have contributed to a better understanding of chronic pain and its treatment options. This increased awareness may lead to more individuals seeking medical advice and appropriate medications for their pain conditions. In 2025, it is estimated that around 40% of Italians are actively seeking information on pain management, indicating a shift towards proactive healthcare. Consequently, the pain relief-medication market may experience a surge in demand for both prescription and over-the-counter medications as patients become more informed about their options.

Shift Towards Natural and Alternative Remedies

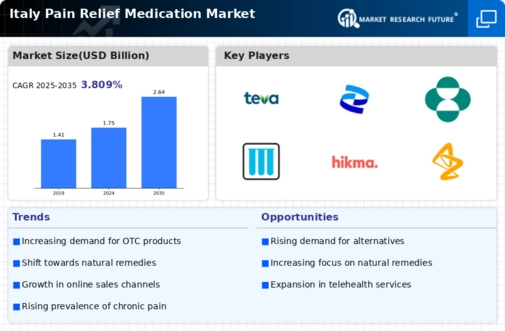

The shift towards natural and alternative remedies is becoming increasingly prominent in Italy, influencing the pain relief-medication market. Many consumers are seeking holistic approaches to pain management, which may include herbal supplements and homeopathic treatments. This trend suggests a potential decline in the reliance on traditional pharmaceuticals, as individuals look for safer and more natural alternatives. In 2025, it is estimated that the market for natural pain relief products could grow by 15%, reflecting a significant change in consumer preferences. The pain relief-medication market may need to adapt by incorporating natural ingredients into their formulations or developing new products that align with this growing demand.

Technological Advancements in Drug Development

Technological advancements in drug development are poised to play a crucial role in shaping the pain relief-medication market. Innovations such as personalized medicine and advanced drug delivery systems may enhance the efficacy and safety of pain relief medications. In Italy, pharmaceutical companies are increasingly investing in research and development to create novel formulations that target specific pain pathways. This trend could lead to the introduction of more effective pain relief options, potentially increasing market share. The pain relief-medication market may also benefit from collaborations between tech firms and pharmaceutical companies, resulting in the development of smart medications that provide real-time feedback on pain management.