Rising Incidence of Chronic Pain

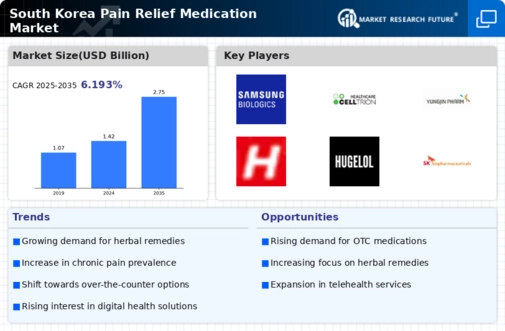

The increasing prevalence of chronic pain conditions in South Korea is a significant driver for the pain relief medication market. According to recent health statistics, approximately 30% of the adult population experiences chronic pain, which necessitates effective pain management solutions. This growing patient demographic is likely to boost demand for various pain relief medications, including over-the-counter and prescription options. Furthermore, the aging population, which is projected to reach 20% by 2025, may exacerbate this trend, as older individuals are more susceptible to chronic pain conditions. Consequently, pharmaceutical companies are focusing on developing innovative pain relief medications tailored to this demographic, thereby enhancing their market presence in the pain relief-medication market.

Increased Awareness of Pain Management

There is a notable rise in awareness regarding pain management strategies among healthcare professionals and patients in South Korea. Educational initiatives and campaigns aimed at informing the public about chronic pain and its treatment options have gained traction. This heightened awareness is likely to lead to increased consultations with healthcare providers, resulting in a greater demand for pain relief medications. Moreover, the pain relief-medication market is expected to benefit from the growing recognition of the importance of addressing pain as a critical component of overall health. As patients become more informed about their treatment options, they may actively seek out effective pain relief solutions, thereby driving market growth.

Advancements in Pharmaceutical Research

Ongoing advancements in pharmaceutical research and development are poised to significantly impact the pain relief-medication market. Innovative drug formulations and delivery systems are being explored to enhance the efficacy and safety of pain relief medications. For instance, the development of long-acting formulations and combination therapies may provide more effective pain management solutions for patients. Additionally, research into the mechanisms of pain and the identification of new therapeutic targets could lead to the introduction of novel medications. As a result, pharmaceutical companies are likely to invest heavily in R&D, which may yield new products that cater to the evolving needs of patients in the pain relief-medication market.

Growing Demand for Over-the-Counter Medications

The demand for over-the-counter (OTC) pain relief medications in South Korea is on the rise, driven by consumer preferences for accessible and convenient treatment options. Many individuals are opting for OTC medications to manage mild to moderate pain without the need for a prescription. This trend is likely to be fueled by the increasing availability of various OTC pain relief products in pharmacies and retail outlets. Additionally, the pain relief-medication market may experience growth as consumers become more proactive in managing their health and seek immediate relief from pain. As a result, manufacturers are expected to expand their OTC product lines to cater to this growing consumer base.

Regulatory Support for Pain Management Solutions

The regulatory environment in South Korea appears to be increasingly supportive of pain management solutions, which may positively influence the pain relief-medication market. Recent policy changes have aimed at streamlining the approval process for new medications, thereby facilitating quicker access to innovative pain relief options. Furthermore, the government has recognized the importance of addressing pain management as part of public health initiatives, which may lead to increased funding for research and development in this area. This supportive regulatory framework could encourage pharmaceutical companies to invest in the development of new pain relief medications, ultimately benefiting patients and healthcare providers alike.