Public Awareness and Engagement

Public awareness regarding waste management practices is a crucial driver for the smart waste-management market in Italy. As citizens become more informed about the environmental impacts of waste, there is a growing demand for efficient waste disposal solutions. Educational campaigns and community engagement initiatives are fostering a culture of sustainability, encouraging individuals to participate actively in recycling programs. This heightened awareness is likely to increase the adoption of smart waste solutions, as residents seek to contribute to cleaner urban environments. Furthermore, municipalities are leveraging mobile applications to engage citizens, providing real-time information on waste collection schedules and recycling guidelines. This engagement not only enhances community participation but also drives the growth of the smart waste-management market, as more individuals advocate for innovative waste solutions.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the smart waste-management market in Italy. The Italian government has been actively promoting sustainable waste management practices through various programs and incentives. Financial support for municipalities to adopt smart waste technologies is becoming more prevalent, facilitating the transition to more efficient systems. For instance, funding for the installation of smart bins and waste tracking systems is being allocated to enhance waste management infrastructure. This support not only aids in reducing operational costs but also aligns with Italy's environmental goals. The smart waste-management market is likely to benefit from these initiatives, as increased funding can accelerate the adoption of innovative solutions, ultimately leading to improved waste management outcomes across the country.

Urbanization and Population Growth

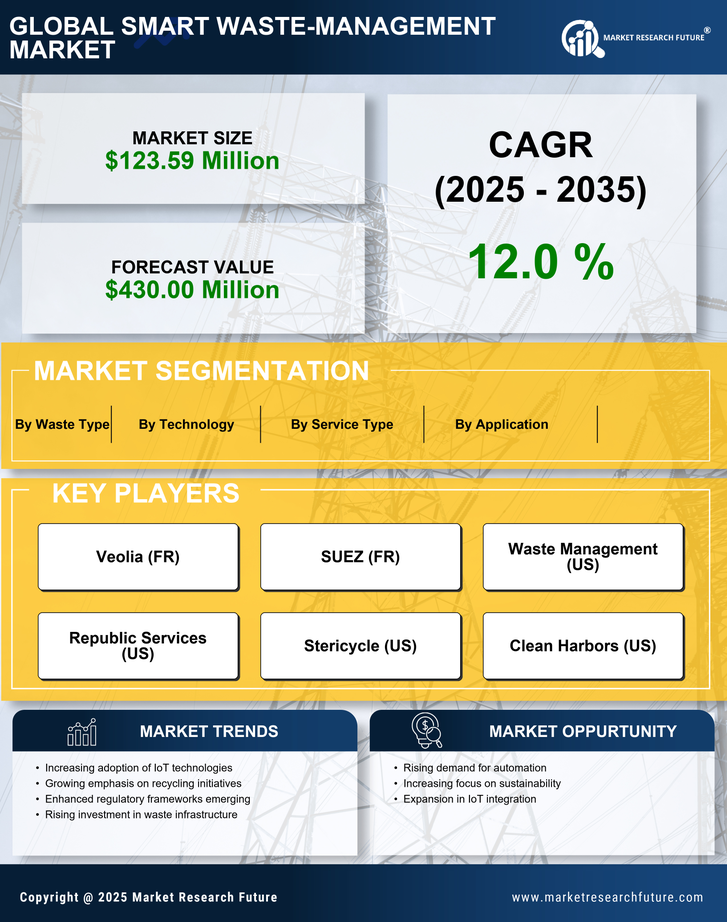

Urbanization and population growth are significant factors influencing the smart waste-management market in Italy. As cities expand and populations increase, the volume of waste generated rises correspondingly. This trend necessitates the implementation of advanced waste management solutions to handle the growing waste streams effectively. In urban areas, the demand for efficient waste collection and disposal systems is paramount, prompting municipalities to invest in smart technologies. The smart waste-management market is projected to see a compound annual growth rate (CAGR) of approximately 15% over the next five years, driven by the need for scalable waste management solutions. Additionally, urban centers are increasingly adopting smart bins and automated collection systems to manage waste more effectively, thereby addressing the challenges posed by urbanization.

Environmental Regulations and Compliance

Environmental regulations and compliance requirements are driving the smart waste-management market in Italy. Stricter regulations aimed at reducing landfill waste and promoting recycling are compelling municipalities to adopt smarter waste management solutions. Compliance with these regulations often necessitates the implementation of advanced tracking and reporting systems, which are integral to the smart waste-management market. As Italy strives to meet EU directives on waste reduction, municipalities are increasingly investing in technologies that facilitate compliance. This trend is likely to propel the market forward, as the need for efficient waste tracking and reporting systems becomes more pronounced. The smart waste-management market is expected to expand as municipalities seek to align with regulatory requirements while enhancing their operational efficiency.

Technological Advancements in Waste Management

The smart waste-management market in Italy is experiencing a surge due to rapid technological advancements. Innovations such as AI-driven analytics and IoT-enabled sensors are enhancing operational efficiency. These technologies facilitate real-time monitoring of waste levels, optimizing collection routes and schedules. As a result, municipalities can reduce operational costs by up to 30%, while improving service delivery. The integration of smart bins equipped with sensors is becoming increasingly common, allowing for better tracking of waste types and volumes. This trend not only streamlines waste collection but also promotes recycling efforts, aligning with Italy's commitment to sustainability. The smart waste-management market is projected to grow significantly, with an estimated value reaching €1 billion by 2027, driven by these technological innovations.