Consumer Demand for Security

In Italy, there is a growing consumer demand for enhanced security measures in financial transactions. As awareness of cyber threats increases, customers are more inclined to choose financial institutions that prioritize security. Surveys indicate that 80% of consumers consider transaction security a key factor when selecting a bank. This heightened demand drives financial institutions to invest in advanced transaction monitoring systems that can provide real-time alerts and comprehensive fraud detection. As a result, the transaction monitoring market is likely to expand, as organizations strive to meet consumer expectations and build trust through robust security measures.

Evolving Regulatory Landscape

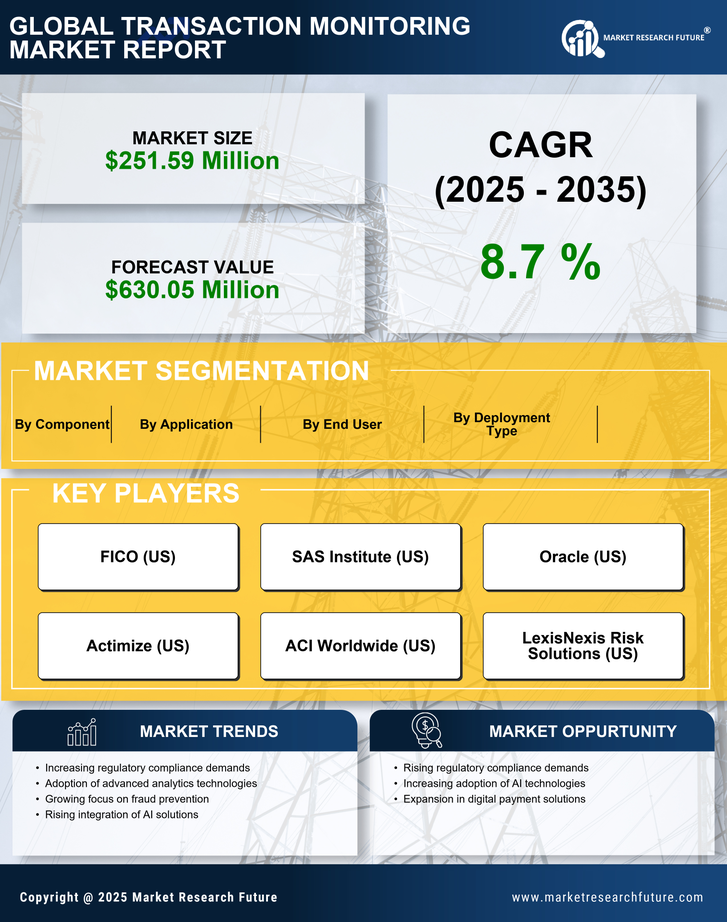

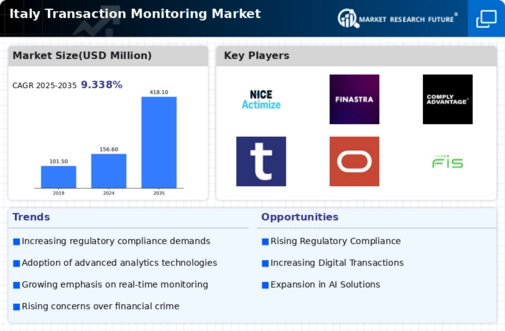

The regulatory environment in Italy is continuously evolving, which significantly impacts the transaction monitoring market. Authorities are increasingly implementing stringent regulations aimed at combating money laundering and terrorist financing. In 2025, compliance costs for financial institutions are projected to rise by 15%, as they invest in sophisticated monitoring technologies to adhere to these regulations. This regulatory pressure compels organizations to adopt comprehensive transaction monitoring systems that can ensure compliance and mitigate risks. As a result, the transaction monitoring market is expected to expand, driven by the necessity for businesses to align with regulatory requirements and avoid hefty penalties.

Increasing Fraudulent Activities

The rise in fraudulent activities in Italy has become a critical driver for the transaction monitoring market. As financial crimes evolve, organizations are compelled to enhance their monitoring systems to detect and prevent fraud effectively. In 2025, it is estimated that losses due to fraud in the financial sector could reach €5 billion, prompting banks and financial institutions to invest heavily in advanced transaction monitoring solutions. This trend indicates a growing recognition of the need for robust systems that can analyze transaction patterns and flag suspicious activities in real-time. Consequently, The market is likely to experience significant growth as businesses seek to safeguard their assets and maintain customer trust..

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Italy are reshaping the transaction monitoring market. As businesses increasingly adopt digital platforms for transactions, the volume of data generated has surged. In 2025, it is anticipated that digital transactions will account for over 70% of all financial transactions in Italy. This shift necessitates the implementation of advanced transaction monitoring solutions capable of processing large datasets efficiently. Organizations are likely to invest in artificial intelligence and machine learning technologies to enhance their monitoring capabilities. Consequently, the transaction monitoring market is poised for growth as companies seek to leverage technology to improve their fraud detection and compliance processes.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the transaction monitoring market in Italy. These technologies enable organizations to analyze vast amounts of transaction data more effectively, identifying patterns and anomalies that may indicate fraudulent activities. In 2025, it is projected that the adoption of AI-driven monitoring solutions will increase by 25%, as businesses seek to enhance their operational efficiency and reduce false positives. This technological advancement not only improves the accuracy of fraud detection but also streamlines compliance processes. Consequently, the transaction monitoring market is expected to grow as organizations leverage these innovations to strengthen their monitoring capabilities.