Rising Consumer Expectations

Rising consumer expectations regarding internet speed and reliability are driving the 5g customer-premises-equipment market in Japan. As more individuals and businesses rely on high-speed internet for daily activities, the demand for advanced customer-premises equipment is becoming increasingly pronounced. Surveys indicate that over 70% of consumers prioritize high-speed connectivity when choosing internet service providers. This trend suggests that customers are willing to invest in superior equipment to ensure optimal performance. Consequently, manufacturers are responding by developing innovative solutions that cater to these heightened expectations, further stimulating the growth of the market.

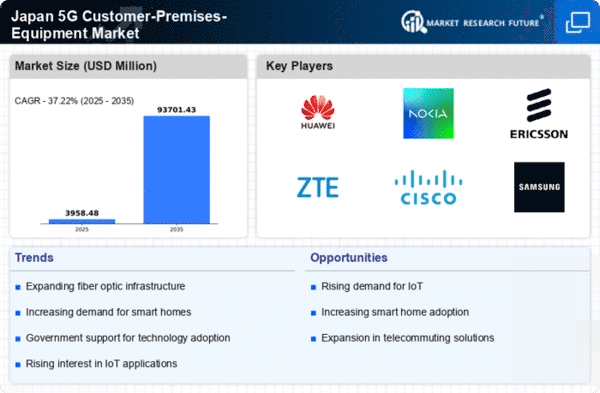

Expansion of 5G Infrastructure

The ongoing expansion of 5G infrastructure in Japan is a pivotal driver for the 5g customer-premises-equipment market. As telecommunications companies invest heavily in enhancing their networks, the demand for customer-premises equipment is expected to rise. Reports indicate that the investment in 5G infrastructure could reach approximately $20 billion by 2025, reflecting a robust commitment to improving connectivity. This expansion not only facilitates faster internet speeds but also supports a wider range of applications, from smart homes to industrial automation. Consequently, the growth of 5G infrastructure is likely to stimulate the demand for advanced customer-premises equipment, which is essential for consumers and businesses to fully leverage the capabilities of 5G technology.

Government Initiatives and Support

Government initiatives in Japan play a crucial role in propelling the 5g customer-premises-equipment market. The Japanese government has been actively promoting the adoption of 5G technology through various policies and funding programs. For instance, the Ministry of Internal Affairs and Communications has allocated significant resources to support the deployment of 5G networks across urban and rural areas. This support is expected to enhance the accessibility of 5G services, thereby increasing the demand for customer-premises equipment. Furthermore, the government's commitment to fostering innovation in telecommunications is likely to create a favorable environment for market growth, as businesses and consumers seek to upgrade their equipment to take advantage of new capabilities.

Increased Adoption of Smart Devices

The increased adoption of smart devices in Japan is significantly influencing the 5g customer-premises-equipment market. As households and businesses integrate more smart technologies, the need for robust and efficient customer-premises equipment becomes paramount. Data shows that the number of connected devices per household is projected to exceed 20 by 2025, necessitating equipment that can handle multiple connections seamlessly. This trend indicates a shift towards more sophisticated networking solutions, which are essential for managing the demands of smart devices. As a result, the market for customer-premises equipment is likely to expand, driven by the need for devices that can support the growing ecosystem of smart technologies.

Competitive Landscape and Innovation

The competitive landscape in Japan's telecommunications sector is fostering innovation within the 5g customer-premises-equipment market. With multiple players vying for market share, companies are increasingly focused on developing cutting-edge technologies to differentiate their offerings. This competition is likely to lead to advancements in customer-premises equipment, such as enhanced performance, improved energy efficiency, and greater compatibility with various devices. As firms invest in research and development, the market is expected to witness a surge in innovative products that meet the evolving needs of consumers and businesses alike. This dynamic environment not only drives growth but also encourages the adoption of 5G technology across various sectors.

Leave a Comment