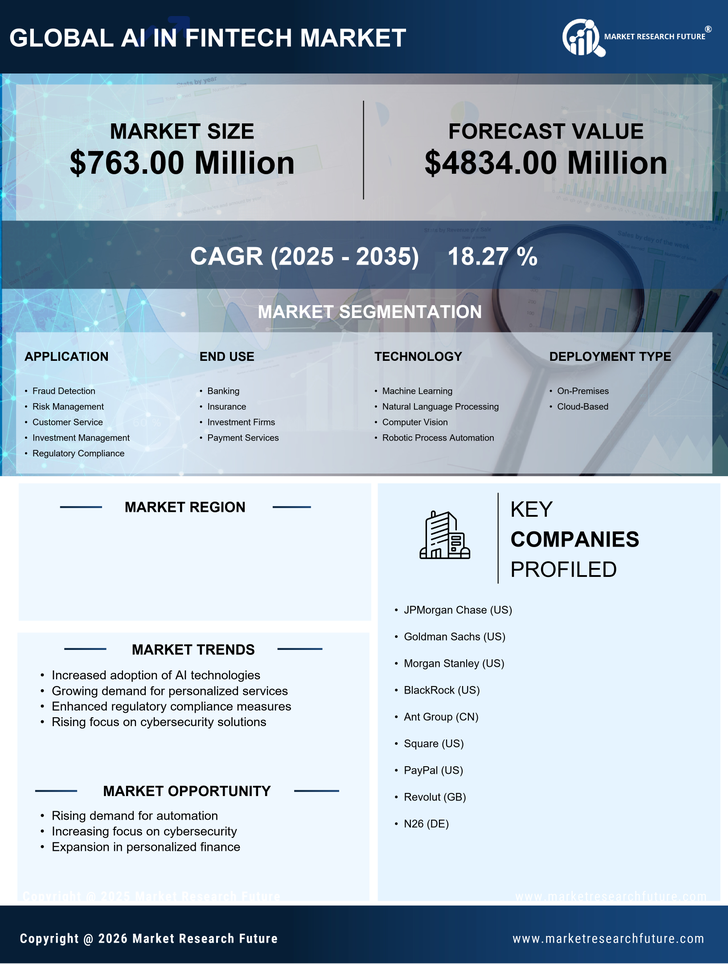

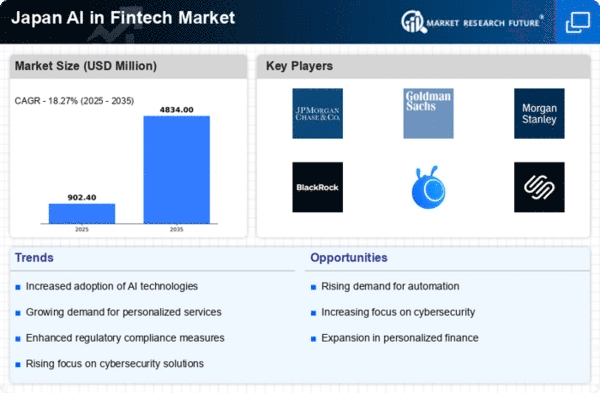

Growing Cybersecurity Concerns

In the context of the ai in-fintech market, cybersecurity has emerged as a critical driver for innovation and investment. With the increasing digitization of financial services, Japanese consumers and businesses are becoming more aware of the risks associated with data breaches and cyberattacks. Recent statistics indicate that cybercrime costs the Japanese economy over $1 billion annually, prompting financial institutions to prioritize cybersecurity measures. AI technologies are being leveraged to enhance security protocols, detect anomalies, and respond to threats in real-time. This focus on cybersecurity not only protects sensitive financial data but also builds consumer trust, which is essential for the growth of the ai in-fintech market. As financial institutions invest in AI-driven security solutions, the overall market is expected to witness substantial growth.

Advancements in Data Analytics Capabilities

Advancements in data analytics capabilities are significantly influencing the ai in-fintech market in Japan. Financial institutions are increasingly recognizing the value of data-driven decision-making, which is facilitated by AI technologies. The ability to analyze large datasets allows for improved risk assessment, customer insights, and operational efficiency. Recent reports suggest that the market for AI-driven data analytics in the financial sector is projected to grow by over 25% annually. This growth is attributed to the increasing reliance on data for strategic planning and competitive advantage. As financial institutions invest in sophisticated analytics tools, the ai in-fintech market is expected to expand, enabling more informed decision-making and enhanced service delivery.

Regulatory Frameworks Supporting AI Adoption

The regulatory environment in Japan is evolving to support the adoption of AI technologies within the financial sector. Recent initiatives by the Financial Services Agency (FSA) aim to create a conducive framework for innovation while ensuring consumer protection. This regulatory support is crucial for the ai in-fintech market, as it encourages financial institutions to explore AI applications without the fear of non-compliance. The FSA's guidelines on AI usage in risk management and customer service are expected to foster a more robust market. As regulations become more favorable, financial institutions are likely to increase their investments in AI technologies, further propelling the growth of the ai in-fintech market in Japan.

Shift Towards Personalized Financial Services

The ai in-fintech market is witnessing a significant shift towards personalized financial services, driven by changing consumer expectations in Japan. Customers increasingly demand tailored solutions that cater to their individual financial needs and preferences. AI technologies enable financial institutions to analyze vast amounts of data, allowing for the creation of personalized offerings. Recent surveys indicate that over 70% of Japanese consumers are more likely to engage with financial services that provide personalized recommendations. This trend is prompting banks and fintech companies to invest in AI-driven analytics and customer relationship management systems. By enhancing customer experiences through personalization, the ai in-fintech market is likely to grow, as institutions strive to differentiate themselves in a competitive landscape.

Rising Demand for Automation in Financial Services

The ai in-fintech market in Japan is experiencing a notable surge in demand for automation across various financial services. This trend is driven by the need for efficiency and cost reduction, as financial institutions seek to streamline operations. According to recent data, approximately 60% of Japanese banks are investing in automation technologies, which include AI-driven solutions. These technologies not only enhance operational efficiency but also improve customer service by providing faster response times. As a result, the ai in-fintech market is likely to expand, with automation becoming a core component of financial service offerings. The integration of AI in processes such as loan approvals and fraud detection is expected to further drive this demand, positioning Japan as a leader in adopting innovative financial technologies.