Public-Private Partnerships

Public-private partnerships (PPPs) are emerging as a significant driver in the automotive electric-bus market in Japan. These collaborations between government entities and private companies facilitate the sharing of resources and expertise, accelerating the deployment of electric bus fleets. By pooling investments, stakeholders can mitigate risks associated with the high initial costs of electric bus infrastructure. Recent initiatives have shown that such partnerships can lead to the establishment of pilot programs, which test the feasibility and efficiency of electric buses in urban settings. This collaborative approach is likely to enhance the automotive electric-bus market, as it fosters innovation and encourages wider adoption among public transport operators.

Regulatory Framework Enhancements

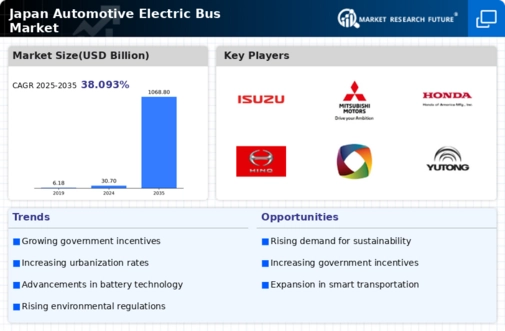

The automotive electric-bus market in Japan is experiencing a robust transformation due to the implementation of stringent regulatory frameworks aimed at reducing emissions. The Japanese government has established ambitious targets for carbon neutrality by 2050, which necessitates a shift towards electric public transportation. This regulatory environment encourages local manufacturers to innovate and invest in electric-bus technologies. Furthermore, compliance with these regulations often leads to financial incentives for operators who transition to electric fleets. As a result, the automotive electric-bus market is likely to see increased adoption rates, with projections indicating a potential growth of over 30% in the next five years as municipalities align their public transport systems with national sustainability goals.

Environmental Sustainability Goals

The automotive electric-bus market in Japan is significantly influenced by the nation's commitment to environmental sustainability. With increasing public concern regarding air quality and climate change, there is a growing demand for cleaner public transport solutions. The Japanese government has set forth ambitious environmental targets, including a reduction of greenhouse gas emissions by 46% by 2030. This commitment drives municipalities to adopt electric buses as a viable alternative to conventional vehicles. As a result, the automotive electric-bus market is expected to expand, with projections indicating a potential increase in market share of electric buses in public transport fleets by 40% over the next decade, aligning with national sustainability objectives.

Economic Viability of Electric Buses

The automotive electric-bus market in Japan is witnessing a shift towards economic viability, driven by decreasing costs of electric bus production and operation. Recent analyses indicate that the total cost of ownership for electric buses is becoming competitive with traditional diesel buses, particularly when considering lower fuel and maintenance costs. This trend is further supported by advancements in battery technology, which have led to longer lifespans and reduced replacement frequencies. As a result, transport operators are increasingly recognizing the financial benefits of transitioning to electric buses, which could lead to a market growth rate of approximately 25% over the next few years, as more entities seek to optimize their operational expenditures.

Infrastructure Development Initiatives

Infrastructure development plays a crucial role in the automotive electric-bus market in Japan. The government is actively investing in charging stations and maintenance facilities to support the growing fleet of electric buses. Recent reports suggest that the number of charging stations is expected to increase by 50% by 2027, facilitating easier access for electric-bus operators. This investment not only enhances the operational efficiency of electric buses but also alleviates range anxiety among potential users. Consequently, the automotive electric-bus market is poised for expansion, as improved infrastructure encourages more transport operators to consider electric options, thereby contributing to a cleaner urban environment.