Japan Biomass Pellets Market Summary

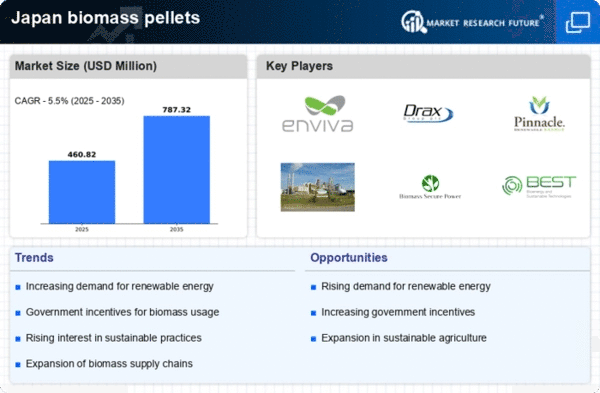

As per Market Research Future analysis, the Japan biomass pellets market size was estimated at 436.8 USD Million in 2024. The Japan biomass pellets market is projected to grow from 460.82 USD Million in 2025 to 787.32 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Japan biomass pellets market is experiencing robust growth driven by renewable energy demand and technological advancements.

- The market is witnessing a rising demand for renewable energy, indicating a shift towards sustainable practices.

- Technological advancements in production processes are enhancing efficiency and reducing costs in biomass pellet manufacturing.

- Diverse feedstock utilization is becoming prevalent, allowing for greater flexibility and sustainability in production.

- Government incentives for renewable energy and increasing industrial applications are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 436.8 (USD Million) |

| 2035 Market Size | 787.32 (USD Million) |

| CAGR (2025 - 2035) | 5.5% |

Major Players

Enviva (US), Drax Group (GB), Pinnacle Renewable Energy (CA), Green Circle Bio Energy (US), Biomass Secure Power (US), Austrian Bioenergy (AT), VänerEnergi (SE), Wood Pellet Association of Canada (CA)