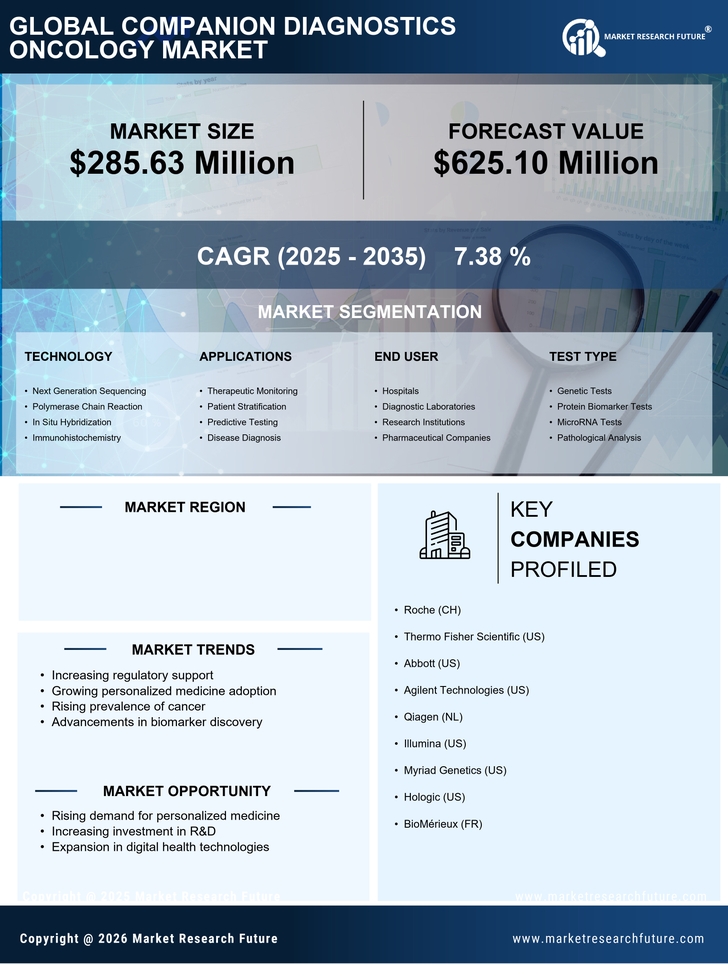

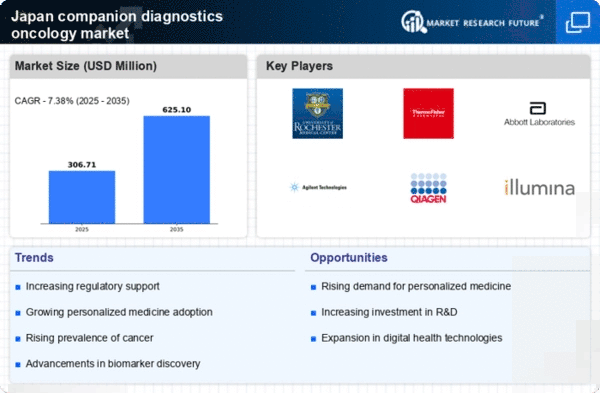

Rising Cancer Incidence

The increasing incidence of cancer in Japan is a primary driver for the companion diagnostics-oncology market. According to the latest statistics, cancer remains the leading cause of death in the country, with approximately 1 in 3 individuals diagnosed during their lifetime. This alarming trend necessitates the development of targeted therapies, which are often accompanied by companion diagnostics to ensure optimal treatment selection. The companion diagnostics-oncology market is expected to grow as healthcare providers seek to improve patient outcomes through personalized treatment plans. Furthermore, the Japanese government has been actively promoting initiatives to enhance cancer care, which may further stimulate demand for companion diagnostics.

Government Initiatives and Funding

Government initiatives aimed at improving cancer care in Japan are playing a crucial role in the growth of the companion diagnostics-oncology market. The Japanese Ministry of Health, Labour and Welfare has implemented various programs to support cancer research and the development of innovative diagnostic tools. Increased funding for research projects and collaborations between public and private sectors are expected to accelerate advancements in companion diagnostics. For instance, the government has allocated substantial budgets for cancer research, which may lead to the discovery of new biomarkers and the development of novel companion diagnostics. This supportive environment is likely to foster growth in the companion diagnostics-oncology market.

Technological Advancements in Diagnostics

Technological innovations in diagnostic tools are significantly influencing the companion diagnostics-oncology market. The advent of next-generation sequencing (NGS) and other advanced molecular techniques has enabled more precise identification of biomarkers associated with various cancers. These advancements facilitate the development of companion diagnostics that can guide oncologists in selecting the most effective therapies for patients. In Japan, the market for molecular diagnostics is projected to reach approximately $1.5 billion by 2026, reflecting a robust growth trajectory. As these technologies continue to evolve, they are likely to enhance the accuracy and efficiency of cancer treatment, thereby driving the companion diagnostics-oncology market.

Growing Awareness of Personalized Medicine

The rising awareness of personalized medicine among healthcare professionals and patients is a significant driver for the companion diagnostics-oncology market. As patients become more informed about their treatment options, there is a growing demand for therapies tailored to individual genetic profiles. This shift towards personalized medicine is prompting oncologists to utilize companion diagnostics to identify the most suitable treatment pathways. In Japan, the market for personalized medicine is expected to expand, with projections indicating a growth rate of around 10% annually. This trend underscores the importance of companion diagnostics in ensuring that patients receive the most effective therapies based on their unique genetic makeup.

Collaboration Between Industry and Academia

Collaborative efforts between the pharmaceutical industry and academic institutions are fostering innovation in the companion diagnostics-oncology market. These partnerships facilitate the sharing of knowledge and resources, leading to the development of new diagnostic tests and therapies. In Japan, several universities and research institutions are actively engaged in research projects aimed at identifying novel biomarkers for cancer treatment. Such collaborations not only enhance the scientific understanding of cancer but also expedite the translation of research findings into clinical applications. As these partnerships continue to grow, they are likely to drive advancements in the companion diagnostics-oncology market, ultimately improving patient outcomes.