Regulatory Framework Enhancements

The evolving regulatory framework in South Korea is positively influencing the companion diagnostics-oncology market. Recent updates to regulations have streamlined the approval processes for diagnostic tests, making it easier for companies to bring innovative products to market. The Ministry of Food and Drug Safety has implemented measures to expedite the review of companion diagnostics, which is likely to encourage more companies to invest in this sector. As a result, the market is expected to grow, with an anticipated increase in the number of approved diagnostic tests that can aid in the treatment of various cancers.

Rising Awareness of Genetic Testing

The growing awareness of genetic testing among patients and healthcare professionals is driving the companion diagnostics-oncology market. In South Korea, educational campaigns and initiatives by healthcare organizations are promoting the benefits of genetic testing in cancer diagnosis and treatment. This heightened awareness is leading to an increase in the number of patients seeking genetic testing services, which in turn supports the demand for companion diagnostics. It is estimated that the market could see a growth of 15% in the next few years as more patients understand the importance of genetic information in their treatment plans.

Increased Investment in Cancer Research

Investment in cancer research is significantly impacting the companion diagnostics-oncology market. In South Korea, both public and private sectors are allocating substantial funds to oncology research initiatives. This financial support is fostering the development of innovative diagnostic tools that can identify specific cancer types and their corresponding treatments. The government has committed over $200 million to cancer research in the past year, which is likely to enhance the capabilities of companion diagnostics. As research progresses, the market is expected to expand, with new diagnostic tests emerging that align with the evolving landscape of cancer treatment.

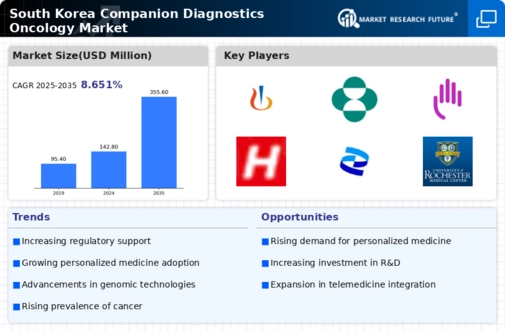

Growing Demand for Personalized Medicine

The shift towards personalized medicine is a key driver for the companion diagnostics-oncology market. In South Korea, healthcare providers are increasingly recognizing the value of tailored treatment approaches that consider individual genetic profiles. This trend is supported by a growing body of evidence indicating that personalized therapies can lead to improved patient outcomes and reduced healthcare costs. The market for companion diagnostics is expected to reach $500 million by 2027, reflecting the rising demand for targeted therapies. As patients and clinicians seek more effective treatment options, the role of companion diagnostics in identifying suitable therapies becomes increasingly critical.

Technological Advancements in Diagnostics

The companion diagnostics-oncology market is experiencing a surge due to rapid technological advancements in diagnostic tools. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) are enhancing the precision of cancer diagnostics. In South Korea, the integration of artificial intelligence in diagnostic processes is streamlining the identification of biomarkers, which is crucial for personalized treatment plans. The market is projected to grow at a CAGR of approximately 10% over the next five years, driven by these technological improvements. Furthermore, the increasing adoption of digital health solutions is facilitating better patient management and outcomes, thereby reinforcing the importance of companion diagnostics in oncology.