Global Supply Chain Integration

The integration of The japan contract logistics market. As Japanese companies expand their operations internationally, the need for efficient logistics solutions that can seamlessly connect domestic and global supply chains becomes paramount. In 2025, it was estimated that around 30% of Japanese manufacturers were actively seeking to optimize their global supply chains through strategic partnerships with logistics providers. This trend is driven by the desire to enhance competitiveness and respond to changing market dynamics. Logistics providers are adapting their services to cater to the complexities of global supply chains, including customs clearance, international shipping, and compliance with various regulations. As globalization continues to shape the business landscape, the Japan contract logistics market is likely to experience increased demand for integrated logistics solutions that facilitate cross-border trade.

Technological Advancements in Logistics

Technological advancements are playing a pivotal role in shaping the Japan contract logistics market. The integration of automation, artificial intelligence, and data analytics is transforming traditional logistics operations. For instance, the adoption of warehouse management systems (WMS) and transportation management systems (TMS) has improved efficiency and accuracy in inventory management and order processing. In 2025, it was estimated that around 60% of logistics companies in Japan had implemented some form of automation in their operations. This trend is expected to continue, as companies seek to reduce operational costs and enhance service quality. Furthermore, the use of real-time tracking and visibility tools is becoming increasingly prevalent, allowing logistics providers to optimize their supply chains and respond swiftly to customer demands. As technology continues to evolve, it is likely to drive further growth and innovation within the Japan contract logistics market.

Rising Demand for E-commerce Fulfillment

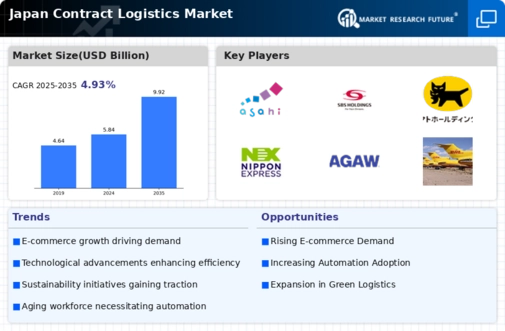

The Japan contract logistics market is experiencing a notable surge in demand for e-commerce fulfillment services. As online shopping continues to gain traction, logistics providers are adapting their operations to meet the needs of e-commerce businesses. In 2025, the e-commerce sector in Japan was valued at approximately 20 trillion yen, indicating a robust growth trajectory. This growth necessitates efficient warehousing, inventory management, and last-mile delivery solutions, which are integral components of contract logistics. Companies are increasingly outsourcing these functions to specialized logistics providers, allowing them to focus on core business activities while ensuring timely and accurate order fulfillment. The rising demand for e-commerce fulfillment is likely to drive innovation and investment in the Japan contract logistics market, as providers seek to enhance their capabilities and service offerings.

Focus on Sustainability and Green Logistics

Sustainability has emerged as a critical focus within the Japan contract logistics market. With growing awareness of environmental issues, logistics providers are increasingly adopting green practices to minimize their carbon footprint. In 2025, it was reported that around 40% of logistics companies in Japan had implemented sustainability initiatives, such as using electric vehicles and optimizing delivery routes to reduce emissions. This shift towards sustainable logistics not only aligns with consumer preferences but also meets regulatory requirements aimed at reducing environmental impact. As companies strive to enhance their corporate social responsibility, the demand for sustainable logistics solutions is expected to rise. Consequently, the Japan contract logistics market is likely to witness a growing emphasis on eco-friendly practices, which may drive innovation and investment in sustainable technologies.

Government Policies Supporting Logistics Infrastructure

Government policies aimed at enhancing logistics infrastructure are significantly influencing the Japan contract logistics market. The Japanese government has been actively investing in transportation networks, including roads, railways, and ports, to facilitate smoother logistics operations. In 2025, the government allocated approximately 1 trillion yen for infrastructure development projects, which are expected to improve connectivity and reduce transit times. Additionally, initiatives promoting public-private partnerships are encouraging collaboration between government entities and logistics providers, fostering innovation and efficiency. These policies not only enhance the overall logistics landscape but also create a conducive environment for contract logistics providers to thrive. As infrastructure improvements continue, the Japan contract logistics market is likely to benefit from increased operational efficiency and reduced costs.