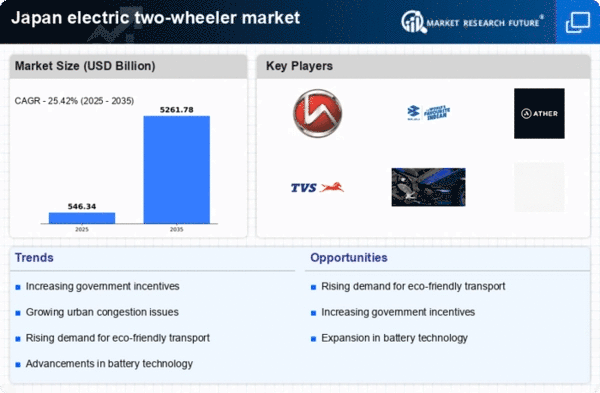

The electric two-wheeler market in Japan is characterized by a rapidly evolving competitive landscape, driven by technological advancements, increasing environmental awareness, and government incentives for electric vehicle adoption. Major players such as Yamaha Motor (Japan), Honda Motor (Japan), and Ather Energy (India) are actively shaping the market dynamics through innovative product offerings and strategic partnerships. Yamaha Motor (Japan) focuses on enhancing its electric scooter lineup, emphasizing performance and sustainability, while Honda Motor (Japan) is investing heavily in R&D to develop next-generation battery technologies. Ather Energy (India) is leveraging its strong digital platform to enhance customer engagement and streamline operations, indicating a trend towards digital transformation in the sector. The business tactics employed by these companies include localizing manufacturing to reduce costs and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share, yet the collective influence of key players is significant. This competitive environment fosters innovation and encourages companies to differentiate themselves through unique value propositions, such as superior technology and customer service. In October 2025, Yamaha Motor (Japan) announced a partnership with a local battery manufacturer to enhance its electric scooter production capabilities. This strategic move is likely to bolster Yamaha's supply chain resilience and reduce dependency on external suppliers, thereby improving its competitive edge in the market. Furthermore, this collaboration may lead to advancements in battery technology, aligning with the growing consumer demand for longer-range electric vehicles. In September 2025, Honda Motor (Japan) unveiled its new electric motorcycle model, which features cutting-edge AI integration for enhanced rider experience. This launch signifies Honda's commitment to innovation and positions the company as a leader in the electric two-wheeler segment. The incorporation of AI technology not only improves performance but also aligns with the increasing consumer preference for smart mobility solutions. In August 2025, Ather Energy (India) expanded its operations into Japan, establishing a local assembly plant to cater to the growing demand for electric scooters. This strategic expansion reflects Ather's ambition to tap into the Japanese market, which is witnessing a surge in electric vehicle adoption. By localizing production, Ather Energy aims to enhance its market presence and respond more effectively to consumer needs. As of November 2025, current competitive trends in the electric two-wheeler market include a strong emphasis on digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the landscape, enabling companies to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on technological advancements, supply chain reliability, and sustainable practices. This shift underscores the importance of innovation as a key driver of success in the electric two-wheeler market.