Regional Insights – Global Battery Swapping for Electric Two-Wheeler Market

North America: pushing demand for compact, efficient transportation

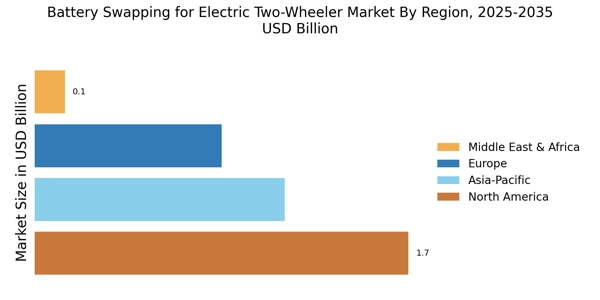

North America is witnessing a growing interest in battery swapping solutions for electric two-wheelers, particularly in urban regions where fast turnaround and high vehicle uptime are essential. A notable example is Ample, a San Francisco-based startup pioneering modular battery swapping. With recent investment of USD 25 million by Mitsubishi, Ample is scaling its infrastructure across the U.S. and expanding into international markets. Its technology allows for complete battery swaps in under five minutes, making it ideal for delivery fleets and shared mobility platforms. Ample’s modular stations are already being piloted in cities like San Francisco and have attracted attention from ride-hailing and logistics companies aiming to reduce downtime and carbon emissions.

Public-private partnerships are also playing a key role in North America’s battery swapping growth. In Jersey City, New Jersey, the city government partnered with Oonee and Swobbee to launch the country’s first public battery swapping stations for e-bikes and e-scooters. These moves reflect a growing recognition of battery swapping not just as a private enterprise solution but as a public mobility infrastructure component.

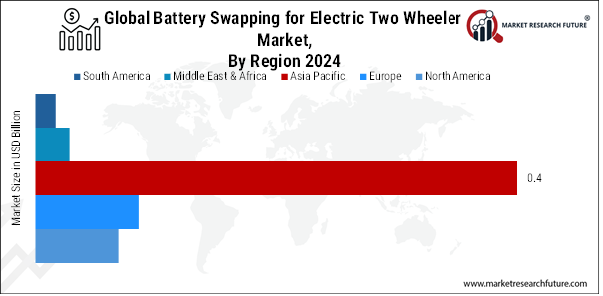

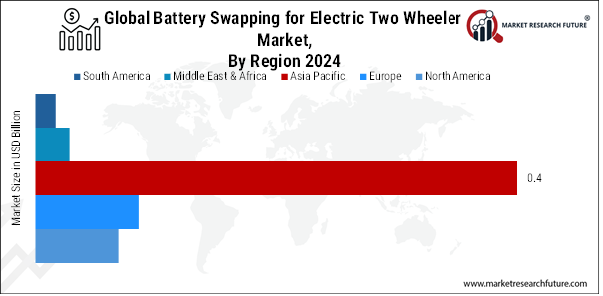

Asia-Pacific held the majority regional market share in 2024

Europe: strong presence of innovative manufacturers

Europe is rapidly embracing battery swapping as part of its clean mobility transition, especially in countries like Germany, the Netherlands, and France. Companies such as Swobbee in Germany are actively deploying multi-battery swapping stations that support various battery types and two-wheeler brands. In 2023, Swobbee partnered with e-scooter companies and logistics startups to launch urban swapping hubs in Berlin, Hamburg, and Paris, offering seamless integration with shared e-mobility services. Additionally, the European Union’s Green Deal and its Fit for 55 package provide strong regulatory backing for battery standardization and EV infrastructure, including modular energy solutions. Cross-sector alliances, like Swobbee and TIER Mobility, are demonstrating the efficiency and urban suitability of swapping in high-demand zones. The interoperability focus across EU states makes Europe a fertile ground for standardized swapping models that serve couriers, fleet operators, and individual users alike. Swapping stations are being integrated into smart city projects and low-emission transport corridors, ensuring convenience, speed, and sustainability.

Asia-Pacific: strong government mandates and subsidies

APAC leads the world in battery swapping for electric two-wheelers, with countries like India, China, Taiwan, and Indonesia rolling out robust networks supported by both government and industry. Gogoro, based in Taiwan, has built over 12,000 Go Stations and facilitates more than 400,000 battery swaps per day, powering e-scooters across multiple cities. In India, Sun Mobility and Bounce Infinity are aggressively expanding their swapping stations, often in partnership with delivery companies and ride-hailing platforms. The Indian government’s Battery Swapping Policy under its EV push encourages interoperability and offers incentives for energy operators and OEMs.

Similarly, in China, players like Aulton and NIO are scaling modular battery exchange networks, demonstrating high levels of technical maturity and user convenience. With vast two-wheeler user bases and space-constrained urban centers, APAC continues to innovate rapidly—deploying smart, app-connected swap stations that reduce downtime and promote fleet electrification. These initiatives are central to the region’s low-carbon mobility goals and digital infrastructure growth.

South American: Increasing urbanization and growing environmental awareness

South America is progressively exploring battery swapping solutions in high-traffic urban zones, particularly in Brazil, Colombia, and Chile, where two-wheelers play a central role in urban commuting and deliveries. Voltz Motors in Brazil has launched a battery swapping model for electric motorcycles and partnered with charging infrastructure providers to expand access across Sao Paulo and Rio de Janeiro. In Colombia, pilot projects involving electric mopeds with swappable batteries are being tested for food and package delivery. Municipal governments in cities like Bogotá are supporting cleaner transport through micro-mobility incentives, making battery swapping a natural fit. Recent public interest in sustainable logistics and partnerships between startups and last-mile delivery platforms are accelerating adoption.

Several regional accelerators are funding energy-as-a-service ventures that integrate solar power with battery swapping stations. The combination of smartphone penetration, growing gig work, and eco-mobility policy support makes South America a promising landscape for modular battery solutions tailored to local urban needs.

Middle East & Africa: Emerging governmental focus on sustainability and clean energy

The MEA region is witnessing emerging battery swapping applications in urban centers like Dubai, Nairobi, and Cape Town, where green mobility and smart infrastructure are strategic priorities. In the UAE, Dubai’s Roads and Transport Authority (RTA) has incorporated electric two-wheelers into its Zero Emissions Transport Roadmap, creating opportunities for battery swapping integration with delivery fleets.

In Africa, Nairobi-based ARC Ride has deployed over 200 electric two-wheelers with a functional battery swapping network to serve local logistics businesses, enabling riders to swap batteries in under minimal time. These initiatives are supported by local innovation hubs and global partners focused on clean energy access. Several pilot programs in Kenya and Ghana are exploring solar-powered swap stations to overcome grid limitations.

Governments are also integrating swapping into sustainable city frameworks and EV adoption plans. MEA’s youthful population, high demand for affordable mobility, and expanding tech ecosystems provide a solid foundation for battery swapping to scale alongside electrification goals.

|

|

|

|

|

|

Region

|

Share of Global Market (2024s est.)

|

Key Drivers

|

Outlook 2025–2035

|

|

North America

|

~Medium

|

pushing demand for compact, efficient transportation

|

Stable growth, strong in fleets

|

|

Europe

|

~Medium

|

strong presence of innovative manufacturers

|

Mature, regulatory driven

|

|

Asia-Pacific

|

~Height

|

strong government mandates and subsidies

|

Moderate CAGR

|

|

Middle East & Africa

|

~low

|

Emerging governmental focus on sustainability and clean energy

|

Emerging growth, infrastructure-led

|

|

South America

|

~low

|

Increasing urbanization and growing environmental awareness

|

Potential Markets

|