Expansion of Agricultural Technologies

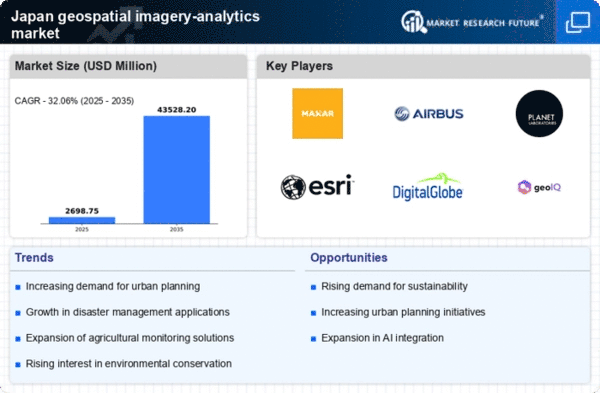

The agricultural sector in Japan is increasingly adopting geospatial imagery-analytics to enhance productivity and sustainability. Farmers and agribusinesses are utilizing geospatial data to optimize crop management, monitor soil health, and improve yield forecasting. The integration of precision agriculture techniques, supported by geospatial analytics, is transforming traditional farming practices. Reports indicate that the agricultural technology market is expected to grow by over 15% annually, with a significant portion of this growth attributed to geospatial technologies. As the demand for food security rises, the geospatial imagery-analytics market is likely to see increased investment and innovation, reflecting the sector's commitment to leveraging data for improved agricultural outcomes.

Increased Focus on Disaster Management

Japan's geographical location makes it prone to natural disasters, necessitating robust disaster management strategies. The geospatial imagery-analytics market plays a pivotal role in this context, providing critical data for risk assessment and emergency response. Advanced analytics can help in predicting disaster impacts and optimizing resource allocation during emergencies. The government has been investing heavily in technologies that enhance disaster preparedness, with estimates suggesting an allocation of approximately $300 million towards geospatial technologies in disaster management. This focus on leveraging geospatial data for safety and resilience is likely to drive growth in the geospatial imagery-analytics market, as stakeholders seek to improve their capabilities in managing disaster risks.

Rising Demand for Urban Planning Solutions

Urbanization in Japan is accelerating, leading to an increased demand for effective urban planning solutions. The geospatial imagery-analytics market is positioned to benefit from this trend, as city planners and local governments seek to utilize geospatial data for infrastructure development and resource management. The integration of geospatial analytics into urban planning processes allows for better visualization of land use, transportation networks, and environmental impacts. Reports indicate that the urban planning sector is expected to allocate over $500 million to geospatial technologies in the coming years. This investment reflects a growing recognition of the value of data-driven decision-making in managing urban growth, thereby enhancing the prospects for the geospatial imagery-analytics market.

Technological Advancements in Remote Sensing

The geospatial imagery-analytics market in Japan is experiencing a surge due to rapid technological advancements in remote sensing technologies. Innovations in satellite imaging, drones, and sensor technologies have enhanced the quality and accuracy of geospatial data. For instance, the resolution of satellite imagery has improved significantly, allowing for more detailed analysis. This is particularly relevant in urban planning and disaster management, where precise data is crucial. The market is projected to grow at a CAGR of approximately 12% over the next five years, driven by these advancements. As organizations increasingly rely on high-resolution imagery for decision-making, the demand for sophisticated analytics tools is likely to rise, further propelling the geospatial imagery-analytics market in Japan.

Growing Interest in Environmental Conservation

Environmental conservation efforts in Japan are gaining momentum, leading to an increased reliance on geospatial imagery-analytics. The market is witnessing a rise in demand for tools that can monitor environmental changes, assess biodiversity, and manage natural resources. Organizations are utilizing geospatial data to track deforestation, water quality, and land use changes, which are critical for sustainable development. The government has set ambitious targets for reducing carbon emissions, and geospatial analytics is seen as a vital component in achieving these goals. With an estimated investment of $200 million in environmental monitoring technologies, the geospatial imagery-analytics market is likely to expand as stakeholders prioritize sustainability and conservation initiatives.