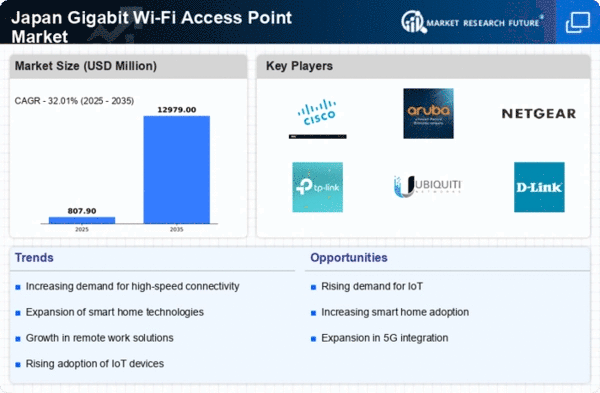

Rising Internet Usage

The increasing reliance on the internet for both personal and professional activities in Japan is a primary driver for the Gigabit Wi-Fi Access Point Market. As of 2025, approximately 90% of households in Japan have internet access, with a significant portion utilizing high-speed connections. This trend is expected to continue, as more individuals engage in remote work, online education, and streaming services. Consequently, the demand for gigabit wi-fi-access-points is likely to surge, as consumers seek reliable and fast internet solutions to support their digital lifestyles. The gigabit wi-fi-access-point market is poised to benefit from this growing need for enhanced connectivity, as users increasingly prioritize speed and reliability in their internet services.

Smart Home Integration

The proliferation of smart home devices in Japan is significantly influencing the gigabit wi-fi-access-point market. With an estimated 30% of households incorporating smart technology by 2025, the demand for robust and high-speed internet connections is paramount. Smart devices, such as security cameras, smart thermostats, and home assistants, require stable and fast internet to function optimally. As consumers invest in these technologies, the need for gigabit wi-fi-access-points becomes evident, as they provide the necessary bandwidth to support multiple devices simultaneously. This trend indicates a shift towards more interconnected living environments, further driving the growth of the gigabit wi-fi-access-point market.

Evolving Consumer Expectations

Consumer expectations regarding internet speed and reliability are evolving rapidly in Japan, driving the gigabit wi-fi-access-point market. As technology advances, users are becoming more discerning about their internet services, with many expecting gigabit speeds as a standard. Surveys indicate that over 60% of consumers prioritize high-speed internet when selecting service providers. This shift in expectations compels manufacturers and service providers to innovate and enhance their offerings, leading to increased competition in the gigabit wi-fi-access-point market. As consumers continue to demand faster and more reliable internet solutions, the market is likely to experience sustained growth, reflecting these changing preferences.

Corporate Digital Transformation

Japanese businesses are increasingly undergoing digital transformation, which is a significant driver for the gigabit wi-fi-access-point market. As companies adopt cloud-based solutions and remote collaboration tools, the demand for high-speed internet infrastructure becomes critical. In 2025, it is projected that over 70% of enterprises in Japan will have implemented some form of digital strategy, necessitating the deployment of gigabit wi-fi-access-points to ensure seamless connectivity. This shift not only enhances operational efficiency but also supports the growing trend of hybrid work environments. The gigabit wi-fi-access-point market stands to gain from this corporate shift towards digitalization, as businesses seek reliable and fast internet solutions.

Increased Mobile Data Consumption

The surge in mobile data consumption in Japan is another key driver for the gigabit wi-fi-access-point market. With mobile data usage expected to rise by 25% annually, consumers are increasingly relying on high-speed internet for their mobile devices. This trend is particularly evident in urban areas, where the demand for fast and reliable internet access is paramount. As users seek to stream high-definition content and engage in online gaming, the need for gigabit wi-fi-access-points becomes apparent. The market is likely to expand as service providers and consumers alike recognize the necessity of robust internet infrastructure to support the growing mobile data demands.