Emergence of 5G Technology

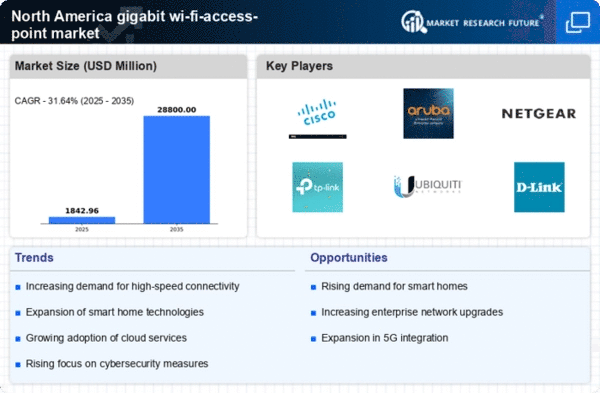

The rollout of 5G technology in North America is anticipated to have a profound impact on the gigabit wi-fi-access-point market. With 5G networks offering significantly higher speeds and lower latency, there is a growing expectation for wi-fi solutions to complement these advancements. As mobile devices increasingly rely on 5G connectivity, the demand for gigabit wi-fi-access-points that can seamlessly integrate with these networks is likely to rise. This convergence of technologies presents opportunities for innovation within the market, as manufacturers develop products that enhance user experiences. The gigabit wi-fi-access-point market must adapt to the evolving landscape shaped by 5G to remain relevant and competitive.

Expansion of Smart Home Devices

The proliferation of smart home devices in North America is significantly influencing the gigabit wi-fi-access-point market. With an estimated 70% of households expected to adopt smart technology by 2026, the demand for high-speed internet to support these devices is paramount. Smart appliances, security systems, and home automation tools require stable and fast connections to function optimally. This trend indicates a growing need for advanced wi-fi solutions that can handle multiple devices simultaneously without compromising performance. As consumers increasingly invest in smart home ecosystems, the gigabit wi-fi-access-point market is likely to experience a corresponding increase in demand for high-capacity access points.

Surge in Remote Work and Learning

The ongoing shift towards remote work and online learning in North America has created a substantial demand for robust internet connectivity. As organizations and educational institutions increasingly rely on digital platforms, the need for high-performance gigabit wi-fi-access-point market solutions has surged. According to recent data, approximately 30% of the workforce in North America is now engaged in remote work, necessitating reliable and fast internet access. This trend is likely to continue, as many companies adopt hybrid work models. Consequently, the gigabit wi-fi-access-point market is poised for growth, driven by the requirement for seamless connectivity that supports video conferencing, online collaboration, and e-learning platforms.

Government Initiatives for Broadband Expansion

Government initiatives aimed at expanding broadband access in underserved areas of North America are likely to bolster the gigabit wi-fi-access-point market. Programs designed to enhance internet infrastructure and provide funding for high-speed connectivity projects are becoming increasingly prevalent. For instance, recent federal investments of over $65 billion aim to improve broadband access nationwide. This focus on connectivity is expected to drive demand for gigabit wi-fi-access-point solutions, particularly in rural and remote regions where traditional internet services may be lacking. As these initiatives progress, the gigabit wi-fi-access-point market stands to benefit from increased adoption and deployment of advanced wi-fi technologies.

Rising Internet Usage and Bandwidth Requirements

The continuous rise in internet usage across North America is a critical driver for the gigabit wi-fi-access-point market. With data consumption increasing by approximately 25% annually, users are demanding higher bandwidth to support activities such as streaming, gaming, and large file transfers. This trend necessitates the deployment of gigabit wi-fi-access-point solutions that can accommodate the growing data traffic. As more households and businesses upgrade their internet plans to gigabit speeds, the market for high-performance access points is expected to expand. The gigabit wi-fi-access-point market must adapt to these evolving bandwidth requirements to remain competitive and meet consumer expectations.