Increasing Regulatory Scrutiny

The healthcare cold-chain-monitoring market in Japan is significantly influenced by increasing regulatory scrutiny surrounding the transportation of temperature-sensitive products. Regulatory bodies are enforcing stringent guidelines to ensure the safety and efficacy of pharmaceuticals and biologics. Compliance with these regulations is essential for market players, as non-compliance can lead to severe penalties and product recalls. In 2025, it is anticipated that the costs associated with regulatory compliance will rise by 15%, prompting companies to invest in advanced monitoring solutions. This trend not only drives the demand for reliable cold-chain monitoring systems but also encourages innovation in tracking technologies, thereby fostering growth in the healthcare cold-chain-monitoring market.

Consumer Awareness and Safety Concerns

Growing consumer awareness regarding the safety and efficacy of healthcare products is a significant driver for the healthcare cold-chain-monitoring market. In Japan, patients and healthcare providers are increasingly concerned about the integrity of temperature-sensitive medications and vaccines. This heightened awareness is leading to a demand for more transparent supply chains and reliable monitoring systems. Surveys indicate that 70% of consumers prioritize product safety, influencing pharmaceutical companies to adopt stringent cold-chain practices. As a result, the healthcare cold-chain-monitoring market is likely to expand as stakeholders seek to enhance product safety and build consumer trust through improved monitoring solutions.

Rising Demand for Biologics and Vaccines

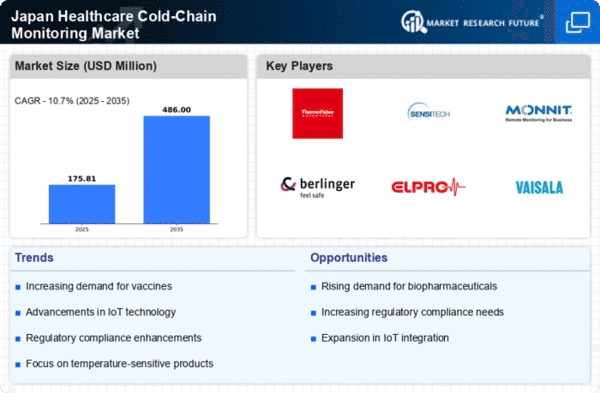

The increasing demand for biologics and vaccines in Japan is a crucial driver for the healthcare cold-chain-monitoring market. As the pharmaceutical industry expands, the need for effective temperature-controlled logistics becomes paramount. Biologics, which often require strict temperature regulations, are projected to account for a significant share of the market. In 2025, the market for biologics in Japan is expected to reach approximately $10 billion, necessitating robust cold-chain solutions to ensure product integrity. This trend underscores the importance of advanced monitoring systems that can provide real-time data on temperature and humidity, thereby enhancing the reliability of the supply chain. Consequently, The healthcare cold-chain monitoring market is expected to experience substantial growth as stakeholders actively seek to meet these evolving demands.

Expansion of E-commerce in Pharmaceuticals

The rapid expansion of e-commerce in the pharmaceutical sector is reshaping the healthcare cold-chain-monitoring market. With more consumers opting for online purchases of medications and health products, the need for efficient cold-chain logistics has become increasingly critical. In Japan, the e-pharmacy market is projected to grow by 25% annually, necessitating robust cold-chain solutions to ensure product quality during transit. This shift towards online sales is prompting logistics providers to invest in advanced monitoring technologies that can maintain optimal conditions throughout the delivery process. Consequently, the healthcare cold-chain-monitoring market is expected to benefit from this trend, as companies strive to meet the demands of a growing e-commerce landscape.

Technological Integration in Supply Chain Management

The integration of advanced technologies in supply chain management is transforming the healthcare cold-chain-monitoring market. Innovations such as IoT devices, blockchain, and AI are enhancing the efficiency and transparency of cold-chain operations. In Japan, the adoption of IoT-enabled monitoring systems is expected to increase by 30% by 2026, driven by the need for real-time tracking and data analytics. These technologies facilitate proactive management of temperature-sensitive products, reducing the risk of spoilage and ensuring compliance with regulatory standards. As healthcare providers and logistics companies increasingly invest in these technologies, the healthcare cold-chain-monitoring market is poised for significant advancements, improving overall operational efficiency and patient safety.