Rising Incidence of Sleep Disorders

The increasing prevalence of sleep disorders in Japan is a primary driver for the sleep testing services market. Recent studies indicate that approximately 30% of the Japanese population experiences some form of sleep disturbance, with conditions such as insomnia and sleep apnea being particularly common. This rising incidence necessitates more comprehensive sleep testing services to diagnose and manage these disorders effectively. As awareness of the health implications associated with poor sleep quality grows, individuals are more likely to seek professional help, thereby expanding the market. The sleep testing-services market is expected to see a surge in demand as healthcare providers enhance their offerings to address this pressing public health issue.

Growing Interest in Preventive Healthcare

The growing interest in preventive healthcare among the Japanese population is influencing the sleep testing services market. As individuals become more health-conscious, there is a noticeable shift towards proactive measures to maintain overall well-being, including the management of sleep health. This trend is reflected in the increasing number of wellness programs and health screenings that incorporate sleep assessments. The market is likely to benefit from this shift, with estimates suggesting a potential growth of 8% as more people seek out sleep testing services as part of their preventive healthcare routines. The emphasis on prevention rather than treatment aligns with broader healthcare trends, positioning the sleep testing-services market for sustained growth.

Government Initiatives to Promote Sleep Health

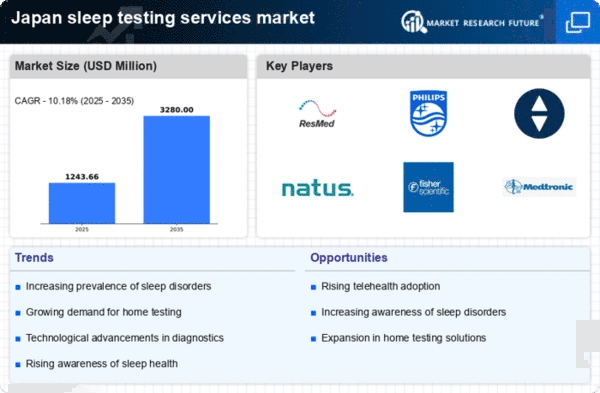

Government initiatives aimed at promoting sleep health are playing a crucial role in the expansion of the sleep testing services market. In Japan, public health campaigns are increasingly focusing on the importance of sleep hygiene and the need for early diagnosis of sleep disorders. These initiatives often include funding for research and development in sleep medicine, as well as subsidies for sleep testing services. As a result, more individuals are encouraged to seek testing and treatment, which could lead to a market growth of approximately 10% in the coming years. The proactive stance of the government in addressing sleep health issues is likely to foster a more informed public, ultimately benefiting the sleep testing-services market.

Integration of Advanced Diagnostic Technologies

The integration of advanced diagnostic technologies into the sleep testing services market is transforming the landscape of sleep medicine in Japan. Innovations such as portable sleep monitors and polysomnography have made it easier for patients to undergo testing in the comfort of their homes. This shift not only improves patient compliance but also reduces the costs associated with traditional sleep labs. The market is projected to grow as these technologies become more accessible and affordable, with estimates suggesting a potential increase in market size by 15% over the next five years. As healthcare providers adopt these technologies, the quality and efficiency of sleep testing services are likely to improve significantly.

Aging Population and Increased Healthcare Demand

Japan's aging population is a significant driver of the sleep testing services market. As the demographic shifts towards an older population, the prevalence of sleep disorders is expected to rise, given that older adults are more susceptible to conditions such as sleep apnea and restless leg syndrome. This demographic trend is likely to increase the demand for sleep testing services, as healthcare providers seek to address the unique needs of elderly patients. Projections indicate that the market could expand by 12% over the next few years, driven by the need for specialized testing and treatment options tailored to this age group. The intersection of an aging population and the sleep testing-services market presents both challenges and opportunities for healthcare providers.