Increased Awareness of Sleep Health

There is a growing recognition of the importance of sleep health among the US population, which is positively impacting the sleep testing-services market. Public health campaigns and educational initiatives are raising awareness about the consequences of poor sleep quality, including its links to chronic health conditions such as obesity, diabetes, and cardiovascular diseases. This heightened awareness is leading more individuals to seek professional help for their sleep issues. As a result, the demand for sleep testing services is likely to rise, as people become more proactive in addressing their sleep-related concerns. The market is thus poised for growth as awareness continues to expand.

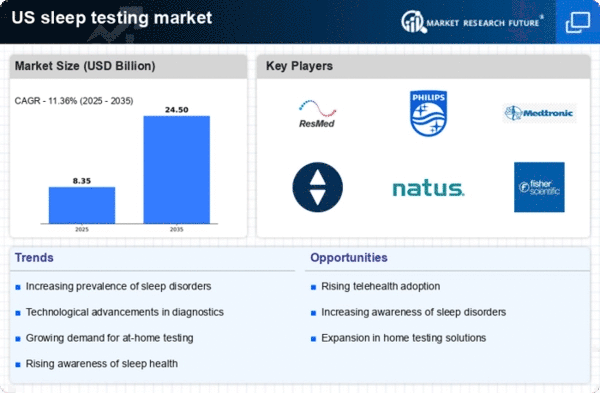

Rising Prevalence of Sleep Disorders

The increasing incidence of sleep disorders in the US is a primary driver for the sleep testing-services market. Conditions such as sleep apnea, insomnia, and restless leg syndrome are becoming more common, affecting millions of individuals. According to the American Academy of Sleep Medicine, approximately 30% of adults report experiencing sleep disturbances. This growing awareness and diagnosis of sleep-related issues are propelling demand for sleep testing services. As healthcare providers recognize the importance of diagnosing and treating these disorders, the market is likely to expand. The the market is thus positioned to benefit from this trend., as more patients seek professional evaluations and treatments.

Technological Advancements in Sleep Monitoring

Innovations in technology are significantly influencing the sleep testing-services market. The development of advanced sleep monitoring devices, including wearable technology and mobile applications, has made it easier for individuals to track their sleep patterns. These devices often provide real-time data, which can be shared with healthcare professionals for more accurate diagnoses. The integration of artificial intelligence in sleep analysis is also enhancing the precision of sleep studies. As these technologies become more accessible and affordable, they are likely to drive an increase in the utilization of sleep testing services. The market is expected to grow as consumers embrace these advancements for better sleep health.

Insurance Coverage Expansion for Sleep Services

The expansion of insurance coverage for sleep testing services is a crucial driver for the sleep testing-services market. Many insurance providers are increasingly recognizing the necessity of diagnosing and treating sleep disorders, leading to improved reimbursement policies. This shift is making sleep testing more accessible to a broader segment of the population, as financial barriers are reduced. As more individuals gain access to these services through their insurance plans, the demand for sleep testing is expected to increase. Consequently, the sleep testing-services market is likely to experience growth as more patients seek covered evaluations and treatments.

Aging Population and Its Impact on Sleep Disorders

The aging population in the US is contributing to the growth of the sleep testing-services market. As individuals age, they often experience a higher prevalence of sleep disorders, including insomnia and sleep apnea. The National Institute of Health indicates that sleep apnea affects approximately 20% of older adults. This demographic shift is prompting healthcare systems to adapt and provide more comprehensive sleep testing services. With an increasing number of elderly individuals seeking diagnosis and treatment for sleep-related issues, the market is expected to expand. The the market is thus likely to benefit. from the growing need for specialized care tailored to this aging population.