Integration of Advanced Technologies

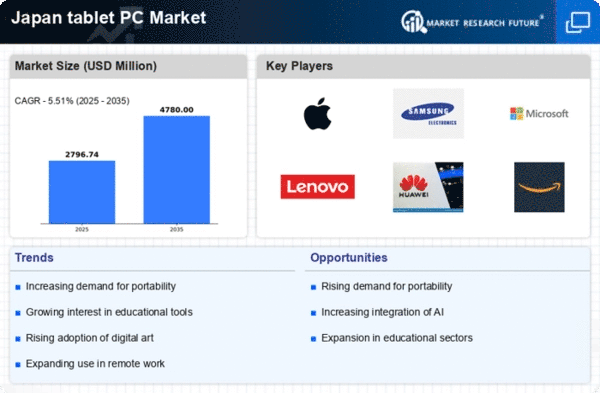

The tablet pc market in Japan is significantly influenced by the integration of advanced technologies such as artificial intelligence (AI) and augmented reality (AR). These innovations enhance user experience and expand the functionality of tablet PCs, making them more appealing to consumers. For instance, AI-driven applications can optimize performance and personalize user interactions, while AR capabilities offer immersive experiences for gaming and education. In 2025, the market is projected to grow by 15% as manufacturers increasingly incorporate these technologies into their devices. This trend suggests that the tablet pc market is evolving to meet the demands of tech-savvy consumers who seek cutting-edge features and enhanced usability.

Expansion of Educational Applications

The tablet pc market in Japan benefits from the expansion of educational applications, as schools and universities increasingly adopt technology in their curricula. Tablet PCs serve as effective tools for interactive learning, enabling students to access educational resources and collaborate on projects. In 2025, it is projected that the education sector will account for approximately 25% of tablet PC sales in Japan. This trend suggests that the tablet pc market is becoming integral to modern education, providing students with the tools necessary for academic success and fostering a more engaging learning environment.

Rising Adoption of Remote Work Solutions

The tablet pc market in Japan experiences a notable surge due to the increasing adoption of remote work solutions. As organizations embrace flexible work arrangements, the demand for portable and efficient devices rises. Tablet PCs, with their lightweight design and versatile functionality, become essential tools for professionals working from home or on the go. In 2025, it is estimated that approximately 35% of the workforce in Japan engages in remote work, driving the need for devices that facilitate productivity and collaboration. This trend indicates a shift in workplace dynamics, where the tablet pc market plays a crucial role in enabling seamless communication and access to information, thereby enhancing overall work efficiency.

Increased Focus on User-Friendly Interfaces

The tablet pc market in Japan is characterized by an increased focus on user-friendly interfaces, as manufacturers strive to enhance the overall user experience. Intuitive designs and simplified navigation are essential for attracting a broader audience, including older adults and non-tech-savvy individuals. In 2025, it is anticipated that user-friendly features will drive a 20% increase in tablet PC sales among these demographics. This trend indicates that the tablet pc market is evolving to cater to diverse user needs, ensuring accessibility and ease of use for all consumers.

Growing Demand for Digital Content Consumption

The tablet pc market in Japan is witnessing a growing demand for digital content consumption, driven by the increasing popularity of streaming services and e-books. As consumers seek convenient ways to access entertainment and information, tablet PCs emerge as ideal devices for reading, watching videos, and browsing the internet. In 2025, it is estimated that over 60% of tablet users in Japan utilize their devices primarily for content consumption. This trend indicates a shift in consumer behavior, where the tablet pc market adapts to meet the needs of users who prioritize multimedia experiences and seamless connectivity.