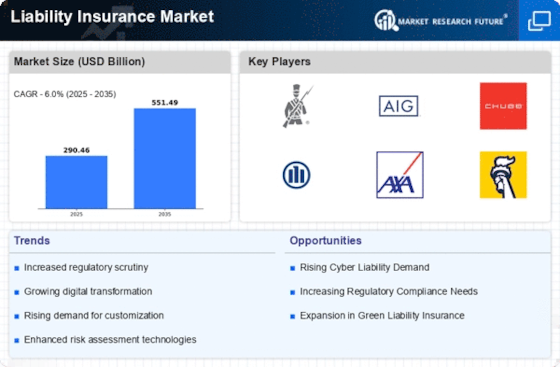

Top Industry Leaders in the Liability Insurance Market

Competitive Landscape of Liability Insurance Market:

The liability insurance market, encompassing protection against financial losses arising from legal liability, is a dynamic and evolving space. Understanding the competitive landscape is crucial for both established players and those eyeing entry. This analysis delves into key players, their strategies, market share factors, and emerging trends, offering a comprehensive picture of the current landscape.

Key Players:

-

AXA SA

-

The Hartford

-

IFFCO-Tokio General Insurance Company Limited

-

Zurich American Insurance Company

-

Liberty General Insurance Limited

-

Allianz

-

Chubb

-

American International Group Inc

-

The Travelers Indemnity Company

-

CNA Financial Corporation

Strategies Adopted:

-

Product Innovation: Developing customized and flexible policies addressing specific industry needs and emerging risks, such as cyber liability and environmental liability.

-

Digital Transformation: Leveraging technology for online quote generation, policy management, and claims processing to improve efficiency and customer experience.

-

Data Analytics: Utilizing data-driven insights to refine underwriting practices, optimize pricing, and identify new market opportunities.

-

Partnerships and Acquisitions: Collaborating with brokers, technology providers, and other insurance companies to expand reach, access new markets, and acquire specialized expertise.

Factors for Market Share Analysis:

-

Financial Strength: An insurer's financial stability and claims-paying ability play a crucial role in customer trust and market share.

-

Brand Reputation: A strong brand, built on reliability, customer service, and innovative product offerings, attracts and retains customers.

-

Distribution Network: Extensive distribution channels, including brokers, agents, and digital platforms, provide greater access to potential customers.

-

Product Portfolio: Offering a diverse range of products catering to different risk profiles and industry segments broadens market appeal.

-

Claims Management: Efficient and transparent claims handling process fosters customer satisfaction and loyalty, leading to repeat business and referrals.

New and Emerging Companies:

-

Insurtech Startups: Leveraging technology to streamline insurance processes, offer customized solutions, and reach underserved markets. Examples include Lemonade, Root Insurance, and Oscar Health.

-

Microinsurance Providers: Providing affordable liability insurance solutions to individuals and small businesses in developing markets. Examples include BIMA (Kenya) and MicroEnsure (India).

-

Captive Insurers: Large corporations establishing their own captive insurance companies to manage risk and control insurance costs.

Current Company Investment Trends:

-

Technology Investment: Investing in data analytics, artificial intelligence, and blockchain technology to enhance underwriting, fraud detection, and customer engagement.

-

Distribution Channel Expansion: Expanding distribution networks through online platforms, partnerships with FinTech companies, and building direct-to-consumer channels.

-

Focus on Emerging Risks: Developing products and services addressing new and evolving risks like cyber security breaches, data privacy concerns, and climate change-related liabilities.

-

Sustainability Initiatives: Integrating environmental, social, and governance (ESG) principles into insurance products and operations to attract socially conscious customers and investors.

Latest Company Updates:

- Jan 26, 2024: Lloyd's of London launches a new cyber insurance platform to streamline underwriting and risk assessment processes.

- Jan 23, 2024: Munich Re partners with cyber security firm Crowdstrike to offer clients enhanced cyber risk management services.

- Jan 19, 2024: Aon acquires rival insurance broker Willis Towers Watson, creating the world's largest insurance brokerage firm.