Rising Litigation Costs

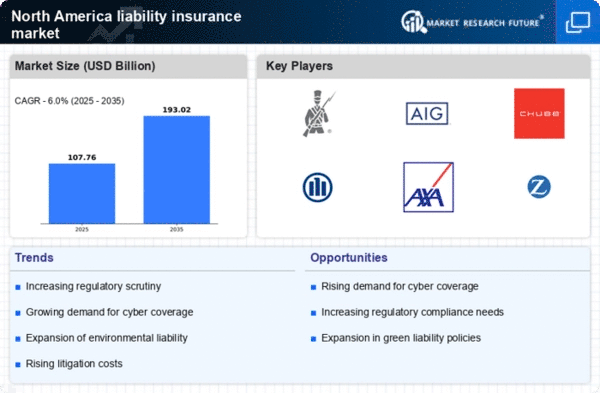

The liability insurance market in North America is experiencing upward pressure due to increasing litigation costs. Legal expenses associated with liability claims have escalated, with average costs rising by approximately 15% over the past few years. This trend compels businesses to secure more comprehensive liability coverage to mitigate financial risks. As companies face higher legal fees and settlements, the demand for liability insurance products intensifies. Insurers are adapting by offering tailored policies that address specific industry risks, thereby enhancing their market position. The rising litigation costs not only affect large corporations but also small and medium-sized enterprises, which may struggle to absorb these expenses without adequate insurance. Consequently, the liability insurance market is likely to see sustained growth as businesses prioritize risk management and legal protection.

Evolving Business Models

The liability insurance market in North America is significantly influenced by the evolution of business models across various sectors. As companies increasingly adopt innovative practices, such as remote work and gig economy structures, the nature of liability risks is changing. For instance, businesses that rely on freelance workers may face unique liability exposures that traditional policies do not adequately cover. This shift necessitates the development of specialized liability insurance products that cater to these new business paradigms. Insurers are responding by creating flexible policies that can adapt to the dynamic nature of modern work environments. The market is projected to grow as businesses seek coverage that aligns with their operational changes, indicating a robust demand for liability insurance solutions tailored to contemporary business needs.

Increased Awareness of Risk Management

There is a growing awareness of risk management among businesses in North America, which is positively impacting the liability insurance market. Companies are increasingly recognizing the importance of protecting their assets and reputations from potential liabilities. This heightened awareness is reflected in a reported 20% increase in the number of businesses seeking liability insurance in the past year. As organizations prioritize risk assessment and mitigation strategies, they are more inclined to invest in comprehensive liability coverage. This trend is particularly evident in industries such as construction and healthcare, where the potential for claims is substantial. The liability insurance market is likely to benefit from this shift, as businesses actively seek to safeguard their operations against unforeseen risks.

Technological Advancements in Underwriting

Technological advancements are reshaping the underwriting processes within the liability insurance market in North America. Insurers are increasingly leveraging data analytics and artificial intelligence to assess risks more accurately and efficiently. This shift allows for more precise pricing of liability insurance products, which can lead to increased competitiveness in the market. For instance, the use of predictive modeling has enabled insurers to identify potential claims before they occur, thereby reducing overall costs. As technology continues to evolve, it is expected that the liability insurance market will see enhanced operational efficiencies and improved customer experiences. Insurers that adopt these technologies may gain a competitive edge, potentially leading to a more dynamic and responsive market landscape.

Growing Demand for Environmental Liability Coverage

The liability insurance market in North America is witnessing a growing demand for environmental liability coverage. As businesses face increasing scrutiny regarding their environmental impact, the need for insurance that addresses potential environmental liabilities is becoming more pronounced. Regulatory changes and public awareness surrounding environmental issues are driving this trend. Companies in sectors such as manufacturing and construction are particularly affected, as they may be held liable for environmental damages. The market for environmental liability insurance is projected to expand, with estimates suggesting a growth rate of around 10% annually. Insurers are responding by developing specialized products that cater to the unique risks associated with environmental liabilities, thereby enhancing their offerings in the liability insurance market.