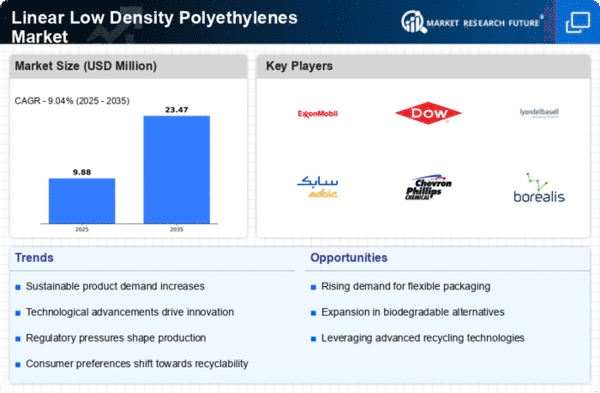

North America : Market Leader in Polyethylenes

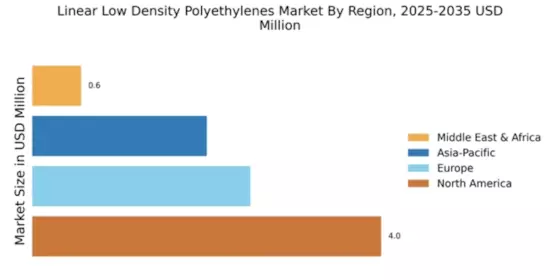

North America is poised to maintain its leadership in the Linear Low Density Polyethylenes (LLDPE) market, holding a significant share of 4.0 in 2025. The region's growth is driven by robust demand from packaging, automotive, and construction sectors, alongside favorable regulations promoting sustainable materials. The increasing focus on recycling and eco-friendly products further catalyzes market expansion, positioning North America as a key player in the global landscape.

The competitive landscape in North America is characterized by the presence of major players such as ExxonMobil, Dow, and LyondellBasell, which contribute to innovation and capacity expansion. The U.S. leads the market, supported by advanced manufacturing capabilities and a strong supply chain. As companies invest in new technologies and sustainable practices, the region is expected to see continued growth, reinforcing its dominant position in the LLDPE market.

Europe : Sustainable Growth and Innovation

Europe's LLDPE market is projected to reach a size of 2.5 by 2025, driven by increasing demand for sustainable packaging solutions and stringent environmental regulations. The European Union's commitment to reducing plastic waste and promoting circular economy initiatives has spurred innovation in the sector. Regulatory frameworks are encouraging the use of recycled materials, which is expected to enhance market growth and align with consumer preferences for eco-friendly products.

Leading countries in Europe include Germany, France, and Italy, where key players like Borealis and TotalEnergies are actively investing in sustainable technologies. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings and market reach. As the region adapts to changing consumer demands and regulatory pressures, the LLDPE market is set to evolve, fostering a more sustainable future.

Asia-Pacific : Rapid Growth and Demand

The Asia-Pacific region is witnessing significant growth in the LLDPE market, projected to reach 2.0 by 2025. This growth is fueled by rising industrialization, urbanization, and increasing demand for packaging materials across various sectors. Countries like China and India are leading the charge, with government initiatives supporting infrastructure development and manufacturing capabilities. The region's favorable economic conditions and growing middle class are further driving demand for LLDPE products.

China stands out as a dominant player in the market, with major companies like SABIC and INEOS expanding their operations to meet local demand. The competitive landscape is characterized by a mix of established players and emerging companies, all vying for market share. As the region continues to develop, the LLDPE market is expected to thrive, supported by innovation and investment in new technologies.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is gradually emerging in the LLDPE market, with a projected size of 0.56 by 2025. The growth is primarily driven by increasing demand for packaging and agricultural applications, alongside government initiatives aimed at boosting the petrochemical industry. The region's abundant natural resources and strategic location provide a competitive advantage for LLDPE production, attracting investments from global players.

Countries like Saudi Arabia and South Africa are at the forefront of this growth, with key players such as Chevron Phillips Chemical and Braskem establishing a strong presence. The competitive landscape is evolving, with local manufacturers ramping up production capabilities to meet rising demand. As the MEA region continues to develop its infrastructure and regulatory frameworks, the LLDPE market is expected to see substantial growth in the coming years.