Market Growth Projections

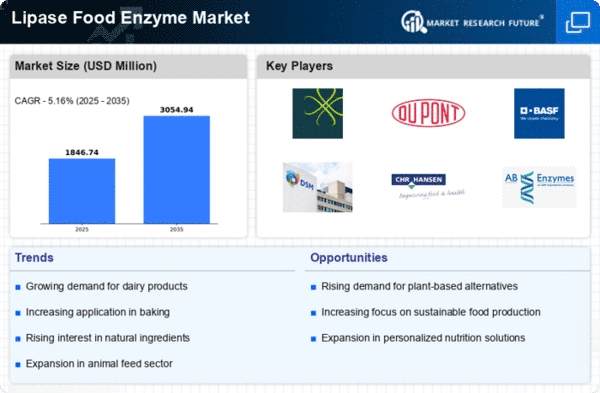

The Global Lipase Food Enzyme Market Industry is poised for substantial growth, with projections indicating a market value of 1.62 USD Billion in 2024 and an anticipated increase to 2.91 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.46% from 2025 to 2035. The increasing application of lipase enzymes across various food sectors, including dairy, bakery, and processed foods, is likely to drive this expansion. As consumer preferences evolve and the demand for functional food ingredients rises, the Global Lipase Food Enzyme Market Industry is expected to experience significant advancements in the coming years.

Expansion of the Dairy Industry

The expansion of the dairy industry is a significant driver for the Global Lipase Food Enzyme Market Industry. Lipase enzymes are essential in dairy processing, particularly in cheese production, where they enhance flavor development and improve texture. As global dairy consumption continues to rise, driven by population growth and changing dietary patterns, the demand for lipase enzymes is expected to increase correspondingly. This trend is particularly pronounced in emerging markets, where dairy consumption is on the rise. The Global Lipase Food Enzyme Market Industry stands to benefit from this expansion, as dairy manufacturers increasingly rely on lipases to enhance product quality.

Health and Nutritional Awareness

A heightened awareness of health and nutrition among consumers is significantly influencing the Global Lipase Food Enzyme Market Industry. As individuals become more conscious of dietary choices, there is a growing preference for products that aid digestion and promote overall well-being. Lipase enzymes play a crucial role in breaking down fats, making them an attractive addition to health-focused food products. This trend is expected to drive market growth, with projections indicating a compound annual growth rate (CAGR) of 5.46% from 2025 to 2035. As health-conscious consumers continue to seek functional foods, the Global Lipase Food Enzyme Market Industry is poised for substantial growth.

Rising Demand for Processed Foods

The increasing global demand for processed foods is a pivotal driver for the Global Lipase Food Enzyme Market Industry. As consumers seek convenience and ready-to-eat options, food manufacturers are incorporating lipase enzymes to enhance flavor and improve fat digestion. This trend is particularly evident in regions with busy lifestyles, where the demand for quick meal solutions is surging. The market is projected to reach 1.62 USD Billion in 2024, reflecting the growing reliance on food enzymes to meet consumer preferences. Consequently, the Global Lipase Food Enzyme Market Industry is likely to expand as manufacturers adapt to these evolving consumer needs.

Growing Vegan and Plant-Based Trends

The growing trend towards vegan and plant-based diets is influencing the Global Lipase Food Enzyme Market Industry. As more consumers adopt plant-based lifestyles, there is an increasing need for enzymes that facilitate the digestion of fats found in plant oils and other sources. Lipase enzymes are vital in ensuring that these fats are effectively broken down, making them more bioavailable. This shift in dietary preferences is expected to drive demand for lipase enzymes in plant-based food products. The market is projected to reach 2.91 USD Billion by 2035, indicating the potential for growth as the plant-based food sector continues to expand.

Technological Advancements in Enzyme Production

Technological advancements in enzyme production are transforming the Global Lipase Food Enzyme Market Industry. Innovations in biotechnology and fermentation processes have led to more efficient and cost-effective production methods for lipase enzymes. These advancements not only enhance enzyme yield but also improve the stability and functionality of lipases in various food applications. As a result, food manufacturers are increasingly adopting these technologies to optimize their production processes. The integration of advanced production techniques is likely to contribute to the market's growth trajectory, as companies strive to meet the rising demand for high-quality food enzymes.