In October 2023, BiOWiSH Technologies, Inc. and MAP (Modern Agricultural Program), the exclusive agricultural service program of Syngenta Group China, declared the formalization of a Strategic Cooperation Agreement to make BiOWiSH® Enhanced Efficiency Fertilizer (EEF) commercially accessible across China. The new EEFs utilize BiOWiSH® Crop Liquid, which is a combination of exclusive microbial cultures applied to dry fertilizer or blended with liquid fertilizers, in order to enhance crop yield in a cost-effective, secure, and environmentally-friendly manner. According to the agreement, MAP will provide a variety of BiOWiSH® EEFs and function as a BiOWiSH distributor in the country.

BiOWiSH® Enhanced Efficiency Fertilizer is specifically formulated to enhance crop productivity by maximizing nutrient absorption and improving soil quality to promote stronger plant growth. BiOWiSH® endophytic Bacillus utilizes BiOWiSH’s exclusive HoloGene 3™ technology to transport essential soil nutrients to crops via the rhizophagy cycle, establishing a mutually beneficial association between the plant and soil microorganisms. The product's distinctive method of operation, along with its exceptional shelf life, has been demonstrated to consistently produce the intended outcomes in a wide variety of operating circumstances, climates, and settings. Furthermore, it is available to farmers at a reasonable cost.

In order to sustain the growth of China's crucial agricultural economy, it is necessary to adopt new ideas and technology due to the challenges posed by excessive cultivation and its impact on soil quality. Microbially enriched fertilizers offer a natural and sustainable solution to address these difficulties.

August 2023: Nutrien Ltd, focused on the advancement of agriculture, said it has released a new series of liquid fertilizers that were designed owing to the requirements of precise farming practices. Such products were elaborated under the brand name of SmartGrow and consisted of complex nourishment for a greener growth of crops while easing up the ecological strain. Nutrien stressed that the new formulations have been developed for use with fertigation systems and are suitable for a range of soils and crops.

Hence, the company has also put another equal amount in stock to aid in setting up some farming applications that can collect data on the fertilization of crops, assisting in precision farming. This development is in deep resonance with the efforts made by Nutrien to enhance eco-friendly agricultural practices.

July 2023: Shoji Internationalsom published YaraRega. These are a line of liquid fertilizers with a focus on highly valuable fruits and vegetables, newly launched products of Yara International. Rega products consist of Nitrogen, phosphorus, potassium and other vitamins essential for the body. The company argued would be effective for agriculture as the aimed to drip irrigate with minimal loss of nutrients and water in the process. Furthermore, the company outlined its commitment to responsible environmental practices through responsible sourcing of raw materials.

There is also targeting new siphons with the European Agricultural cooperatives to increase the use of liquid fertilizers especially in regions of Europe where it is easier to source sustainable farming methods.

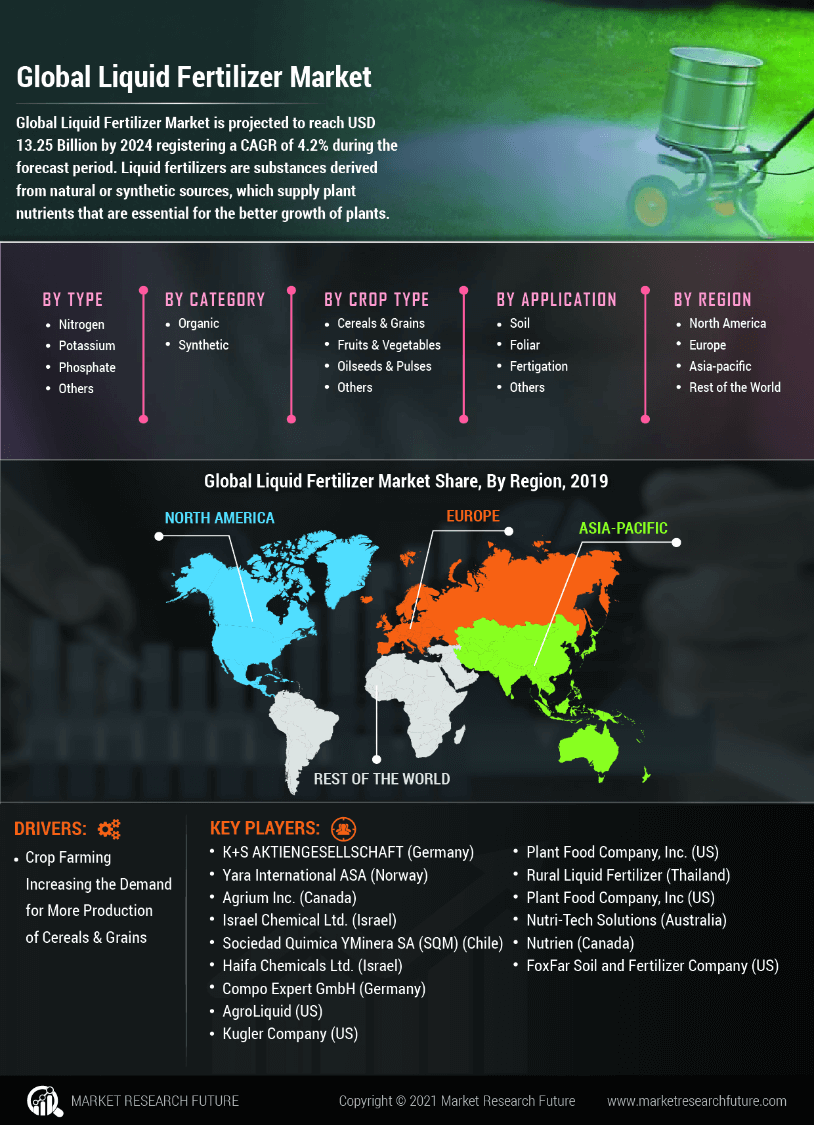

Liquid Fertilizer Key Market Players & Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the Liquid Fertilizer market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Liquid Fertilizer industry must offer cost-effective products to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the Liquid Fertilizer industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, Liquid Fertilizer industry has provided innovative products with some of the most significant benefits. The Liquid Fertilizer market major player such as Nutrien Ltd. (Canada), EuroChem Group (Switzerland), Yara International ASA (Norway), Sociedad Química y Minera de Chile (SQM) (Chile), The Mosaic Company (US), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany) and others are working to expand the market demand by investing in research and development activities.

Nutrien Ltd. is a agriculture company based in Canada that produces and distributes crop inputs, including fertilizers, crop protection products, and seed. The company has operations in over 14 countries and is one of the largest fertilizer producers in the world. In terms liquid fertilizers, Nutrien Ltd. has been actively involved in the market. For instance, in August 2019, the company acquired Actagro, a manufacturer of environmentally sustainable soil and plant health products, including liquid fertilizers. This acquisition expanded Nutrien's portfolio of fertilizer products and strengthened its position in the market.

EuroChem Group is a fertilizer company based in Switzerland that produces and distributes a wide range of fertilizers, including nitrogen, phosphate, and potassium-based fertilizers, as well as other crop nutrients and industrial chemicals. The company operates production facilities in Russia, Europe, and Asia and has a distribution network. It has been actively expanding its production and distribution capabilities. In 2019, the company announced plans to invest over $1 billion in the construction of a new ammonia and urea fertilizer plant in the United States, which will also produce liquid fertilizers.

Moreover, in March 2021, EuroChem Group AG announced a partnership with CropX, an agricultural technology company, to develop a digital platform that will help farmers optimize their use of liquid fertilizers and other crop inputs.

Liquid Fertilizer Industry Developments

September 2020: Yara International ASA announced a partnership with IBM to develop a digital farming platform that will use artificial intelligence and machine learning to help farmers optimize their fertilizer use, including liquid fertilizers.

October 2020: The Andersons, Inc. launched a new line of liquid fertilizers, called "InnoGro Liquid Fertilizers Market," which includes a range of specialty products designed for various crops, including corn, soybeans, and wheat.

- Q2 2024: ICL launches new liquid fertilizer plant in Brazil to meet rising demand ICL Group inaugurated a new liquid fertilizer manufacturing facility in Brazil, aiming to expand its footprint in South America's fast-growing agriculture sector and address increasing demand for high-efficiency crop nutrition solutions.

- Q2 2024: Nutrien announces partnership with Pivot Bio for liquid nitrogen fertilizer innovation Nutrien entered a strategic partnership with Pivot Bio to co-develop and commercialize a new line of microbial-based liquid nitrogen fertilizers, targeting improved sustainability and yield for North American growers.

- Q3 2024: Yara International unveils YaraVita Optimum, a next-generation liquid micronutrient fertilizer Yara International launched YaraVita Optimum, a new liquid fertilizer product designed to enhance micronutrient delivery and crop resilience, with initial rollout in European and Asian markets.

- Q2 2024: EuroChem opens new liquid fertilizer blending facility in China EuroChem officially opened a state-of-the-art liquid fertilizer blending plant in Jiangsu province, China, expanding its production capacity and supporting local precision agriculture initiatives.

- Q1 2025: Coromandel International launches liquid fertilizer product for Indian horticulture market Coromandel International introduced a new liquid fertilizer tailored for horticultural crops, aiming to boost yields and nutrient efficiency for Indian farmers.

- Q2 2025: Haifa Group announces acquisition of Spanish liquid fertilizer producer Agroquimicos del Sur Haifa Group completed the acquisition of Agroquimicos del Sur, strengthening its position in the European liquid fertilizer market and expanding its product portfolio.

- Q2 2024: ICL Group secures major supply contract for liquid fertilizers with Brazilian agribusiness giant Amaggi ICL Group signed a multi-year supply agreement with Amaggi, one of Brazil's largest agribusiness firms, to provide liquid fertilizers for large-scale soybean and corn production.

- Q3 2024: Koch Agronomic Services launches new liquid fertilizer formulation for U.S. corn growers Koch Agronomic Services released a new liquid fertilizer product designed to improve nitrogen uptake and reduce environmental impact for U.S. corn producers.

- Q1 2025: Nutrien appoints new VP of Liquid Fertilizer Business Unit Nutrien announced the appointment of Dr. Maria Lopez as Vice President of its Liquid Fertilizer Business Unit, signaling a renewed focus on innovation and market expansion.

- Q2 2025: EuroChem signs partnership with Chinese agtech firm for smart liquid fertilizer solutions EuroChem entered a partnership with a leading Chinese agtech company to develop smart liquid fertilizer products integrating IoT and data analytics for precision farming.

- Q3 2024: Haifa Group launches new liquid potassium fertilizer for greenhouse crops Haifa Group introduced a liquid potassium fertilizer specifically formulated for greenhouse vegetable production, targeting improved yield and nutrient absorption.

- Q2 2024: ICL Group raises $200 million in green bond offering to fund liquid fertilizer R&D ICL Group successfully raised $200 million through a green bond issuance, with proceeds earmarked for research and development of sustainable liquid fertilizer technologies.