Liquor Confectionery Market Summary

As per Market Research Future analysis, The Global Liquor Confectionery Market Size was estimated at 192.79 USD Billion in 2024. The liquor confectionery industry is projected to grow from 200.58 USD Billion in 2025 to 298.11 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.04% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Liquor Confectionery Market is experiencing dynamic growth driven by innovative flavors and health-conscious offerings.

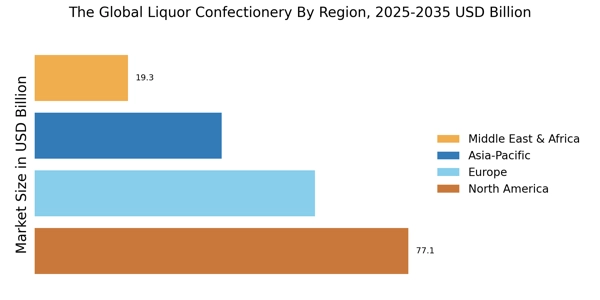

- North America remains the largest market for liquor confectionery, characterized by a strong demand for premium products.

- Asia-Pacific is emerging as the fastest-growing region, with a notable increase in the popularity of novelty products.

- Chocolates dominate the market as the largest segment, while gummies are rapidly gaining traction as the fastest-growing segment.

- The rising demand for premium products and the expansion of e-commerce channels are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 192.79 (USD Billion) |

| 2035 Market Size | 298.11 (USD Billion) |

| CAGR (2025 - 2035) | 4.04% |

Major Players

Mars Inc (US), Ferrero SpA (IT), Mondelez International Inc (US), Nestle SA (CH), Haribo GmbH & Co KG (DE), Lindt & Sprungli AG (CH), Cloetta AB (SE), Perfetti Van Melle (NL), Ghirardelli Chocolate Company (US)