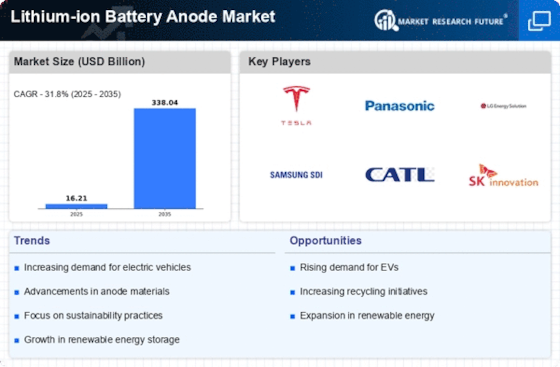

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium-ion Battery Anode Market. As consumers and manufacturers alike prioritize sustainability and reduced carbon emissions, the demand for efficient battery technologies has surged. In 2025, the EV market is projected to grow significantly, with estimates suggesting that over 30 million units will be sold worldwide. This growth directly correlates with the need for advanced lithium-ion batteries, which rely heavily on high-performance anodes. Consequently, manufacturers are investing in research and development to enhance anode materials, particularly silicon-based options, which offer superior energy density. The Lithium-ion Battery Anode Market is thus positioned to benefit from this trend, as the need for innovative anode solutions becomes increasingly critical to meet the demands of the expanding EV sector.

Consumer Electronics Market Expansion

The ongoing expansion of the consumer electronics market is a vital driver for the Lithium-ion Battery Anode Market. As technology advances, the demand for portable electronic devices, such as smartphones, tablets, and laptops, continues to rise. These devices rely heavily on lithium-ion batteries for their power needs, necessitating high-quality anodes to ensure optimal performance. In 2025, the consumer electronics sector is expected to witness substantial growth, with projections indicating a market value exceeding several hundred billion dollars. This growth directly correlates with the demand for advanced battery technologies, prompting manufacturers to innovate and improve anode materials. Consequently, the Lithium-ion Battery Anode Market is likely to thrive as it adapts to the evolving needs of the consumer electronics landscape.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting clean energy solutions are influencing the Lithium-ion Battery Anode Market. Many countries are implementing stringent emissions standards and offering financial incentives for the adoption of electric vehicles and renewable energy storage systems. For instance, tax credits and subsidies for EV purchases are becoming commonplace, encouraging consumers to transition to electric mobility. This regulatory environment fosters a favorable market for lithium-ion batteries, as manufacturers are compelled to enhance their anode technologies to comply with new standards. By 2025, it is anticipated that these policies will significantly boost the demand for high-performance anodes, thereby driving growth in the Lithium-ion Battery Anode Market as companies strive to meet regulatory requirements and consumer expectations.

Growth of Renewable Energy Storage Solutions

The expansion of renewable energy sources, such as solar and wind, is creating a burgeoning demand for energy storage solutions, which in turn supports the Lithium-ion Battery Anode Market. As energy generation from renewables becomes more prevalent, the need for efficient storage systems to manage supply and demand fluctuations is critical. Lithium-ion batteries, with their high energy density and efficiency, are increasingly being utilized in energy storage applications. By 2025, the market for energy storage systems is projected to reach substantial figures, with lithium-ion batteries playing a pivotal role. This trend not only enhances the viability of renewable energy but also drives innovation in anode materials, as manufacturers seek to optimize performance for storage applications. Thus, the Lithium-ion Battery Anode Market stands to gain significantly from the growth of renewable energy storage.

Technological Advancements in Battery Chemistry

Technological innovations in battery chemistry are propelling the Lithium-ion Battery Anode Market forward. Recent advancements have focused on improving the performance and lifespan of lithium-ion batteries, particularly through the development of new anode materials. For instance, the integration of silicon and other composite materials has shown promise in enhancing energy capacity and charge rates. As of 2025, the market for silicon-based anodes is expected to capture a significant share, potentially exceeding 20% of the total anode market. These innovations not only improve battery efficiency but also contribute to cost reductions in manufacturing processes. As a result, the Lithium-ion Battery Anode Market is likely to experience robust growth, driven by the continuous pursuit of higher performance and lower costs in battery technology.

Leave a Comment