Energy Storage Solutions

The growing need for energy storage solutions is emerging as a pivotal driver in the Lithium Ion Battery Dispersant Market. With the increasing integration of renewable energy sources, such as solar and wind, the demand for efficient energy storage systems is on the rise. Lithium-ion batteries are at the forefront of this trend, providing reliable storage options for both residential and commercial applications. The market for energy storage is projected to expand significantly, with estimates suggesting a growth rate of over 15% annually. This expansion creates opportunities for dispersant manufacturers to develop specialized products that enhance the performance and stability of lithium-ion batteries used in energy storage systems.

Electric Vehicle Adoption

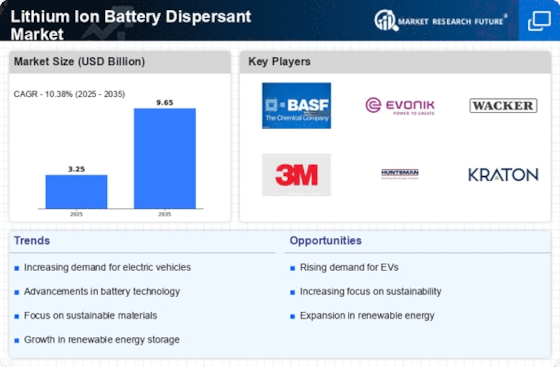

The adoption of electric vehicles (EVs) is a significant driver for the Lithium Ion Battery Dispersant Market. As governments and consumers increasingly prioritize sustainable transportation solutions, the demand for lithium-ion batteries in EVs is expected to rise dramatically. Reports indicate that the EV market could witness a compound annual growth rate exceeding 25% in the next decade. This surge in demand necessitates the development of high-performance dispersants that can enhance battery efficiency and lifespan. Manufacturers focusing on this segment may find lucrative opportunities as they align their products with the evolving needs of the automotive industry, which is rapidly transitioning towards electrification.

Sustainability Initiatives

The Lithium Ion Battery Dispersant Market is experiencing a notable shift towards sustainability initiatives. As environmental concerns gain traction, manufacturers are increasingly focusing on eco-friendly dispersants that minimize environmental impact. This trend is driven by regulatory pressures and consumer demand for greener products. The market for lithium-ion batteries is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is likely to spur innovation in dispersant formulations, leading to the development of bio-based and biodegradable options. Companies that prioritize sustainability in their product offerings may gain a competitive edge, appealing to environmentally conscious consumers and investors alike.

Technological Advancements

Technological advancements play a crucial role in shaping the Lithium Ion Battery Dispersant Market. Innovations in battery technology, such as improved energy density and faster charging capabilities, necessitate the development of advanced dispersants that can enhance performance. The integration of nanotechnology in dispersant formulations is emerging as a key trend, potentially leading to better stability and efficiency in lithium-ion batteries. As the market evolves, manufacturers are likely to invest in research and development to create high-performance dispersants that meet the demands of next-generation batteries. This focus on technology-driven solutions may result in a more competitive landscape, with companies striving to differentiate their products through superior performance.

Rising Demand in Consumer Electronics

The Lithium Ion Battery Dispersant Market is significantly influenced by the rising demand in consumer electronics. With the proliferation of smartphones, laptops, and wearable devices, the need for efficient and reliable lithium-ion batteries has surged. This trend is expected to continue, with the consumer electronics sector projected to account for a substantial share of the lithium-ion battery market. As manufacturers seek to enhance battery performance and longevity, the demand for high-quality dispersants that improve the stability and efficiency of battery formulations is likely to increase. This growing market segment presents opportunities for dispersant producers to innovate and cater to the specific needs of electronics manufacturers.