Advancements in Battery Technology

Technological innovations in battery chemistry and design are propelling the Lithium Ion Battery for Electric Vehicle Market forward. Recent developments have led to batteries with higher energy densities, faster charging capabilities, and improved lifespan. For instance, advancements in solid-state battery technology are expected to enhance safety and performance, potentially revolutionizing the market. As of 2025, the average energy density of lithium ion batteries has improved to around 250 Wh/kg, which is crucial for extending the range of electric vehicles. These advancements not only enhance the appeal of EVs but also drive competition among manufacturers, further stimulating the lithium ion battery market.

Government Policies and Incentives

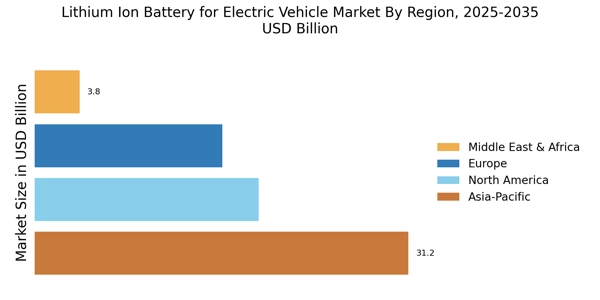

Government policies and incentives play a pivotal role in shaping the Lithium Ion Battery for Electric Vehicle Market. Many countries have implemented stringent regulations aimed at reducing greenhouse gas emissions, which has led to increased investments in electric vehicle infrastructure and technology. For example, tax credits, rebates, and grants for EV purchases are common in various regions, making electric vehicles more accessible to consumers. In 2025, it is estimated that government incentives will account for a significant portion of the EV market growth, thereby directly influencing the demand for lithium ion batteries. This supportive regulatory environment fosters innovation and investment in battery technology, further propelling market expansion.

Rising Demand for Electric Vehicles

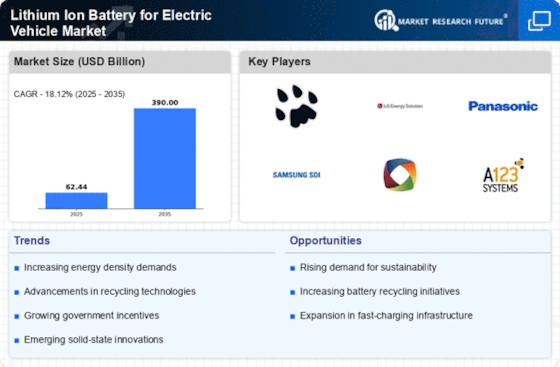

The increasing consumer preference for electric vehicles (EVs) is a primary driver for the Lithium Ion Battery for Electric Vehicle Market. As environmental concerns gain prominence, more consumers are opting for EVs over traditional combustion engine vehicles. In 2025, the demand for EVs is projected to reach approximately 30 million units, significantly boosting the need for lithium ion batteries. This trend is further supported by government incentives and regulations aimed at reducing carbon emissions, which encourage the adoption of electric mobility solutions. Consequently, the growth in EV sales directly correlates with the expansion of the lithium ion battery market, as these batteries are essential for powering electric vehicles efficiently and sustainably.

Expansion of Charging Infrastructure

The expansion of charging infrastructure is a vital factor influencing the Lithium Ion Battery for Electric Vehicle Market. As more charging stations become available, the convenience of owning an electric vehicle increases, thereby attracting a broader consumer base. In 2025, the number of public charging stations is projected to exceed 1 million, significantly enhancing the accessibility of electric vehicles. This infrastructure development alleviates range anxiety among potential EV buyers, making the transition to electric mobility more appealing. Consequently, the growth of charging networks directly correlates with the demand for lithium ion batteries, as a robust charging infrastructure supports the widespread adoption of electric vehicles.

Growing Awareness of Environmental Sustainability

The heightened awareness of environmental sustainability among consumers is a crucial driver for the Lithium Ion Battery for Electric Vehicle Market. As individuals become more conscious of their carbon footprints, the shift towards electric vehicles is increasingly viewed as a responsible choice. This trend is reflected in market data, indicating that approximately 70% of consumers consider environmental impact when purchasing a vehicle in 2025. The demand for sustainable transportation solutions is driving manufacturers to invest in lithium ion battery technology, which is essential for powering electric vehicles. This growing emphasis on sustainability not only influences consumer behavior but also encourages companies to adopt greener practices in battery production.