Rising Demand for Electric Vehicles

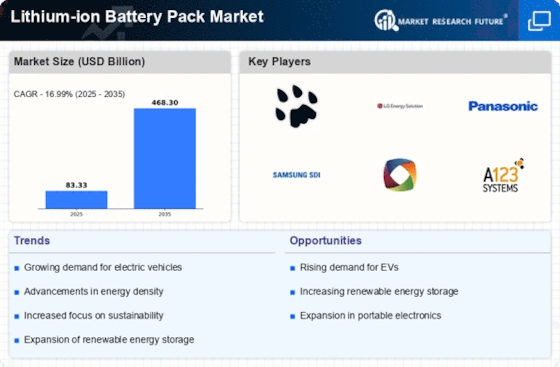

The escalating demand for electric vehicles (EVs) is a crucial driver of the Lithium-ion Battery Pack Market. As consumers become more environmentally conscious and governments promote sustainable transportation, the adoption of EVs is on the rise. In 2025, The Lithium-ion Battery Pack Market is expected to surpass 25 million units, significantly increasing the demand for lithium-ion batteries, which are the primary power source for these vehicles. This trend not only highlights the importance of lithium-ion technology in the automotive sector but also suggests a long-term growth trajectory for the Lithium-ion Battery Pack Market as manufacturers ramp up production to meet this burgeoning demand.

Government Initiatives and Regulations

Government policies aimed at promoting clean energy and reducing carbon emissions are significantly influencing the Lithium-ion Battery Pack Market. Various countries have implemented incentives for electric vehicle adoption and renewable energy projects, which often include the use of lithium-ion batteries. For instance, regulations mandating emissions reductions are driving automotive manufacturers to invest in electric vehicle technology, which relies heavily on lithium-ion battery packs. By 2025, it is estimated that government initiatives will contribute to a 30% increase in the demand for lithium-ion batteries in the automotive sector alone. This regulatory environment is likely to bolster the growth of the Lithium-ion Battery Pack Market.

Increasing Adoption of Portable Electronics

The proliferation of portable electronic devices, such as smartphones, tablets, and laptops, is a primary driver of the Lithium-ion Battery Pack Market. As consumers increasingly rely on these devices for daily tasks, the demand for efficient and long-lasting battery solutions has surged. In 2025, the market for portable electronics is projected to reach approximately 1.5 billion units, necessitating advanced battery technologies. Lithium-ion batteries, known for their high energy density and lightweight characteristics, are favored in this sector. This trend indicates a robust growth trajectory for the Lithium-ion Battery Pack Market, as manufacturers strive to meet consumer expectations for longer battery life and faster charging capabilities.

Expansion of Renewable Energy Storage Solutions

The transition towards renewable energy sources, such as solar and wind, has catalyzed the need for effective energy storage solutions, thereby propelling the Lithium-ion Battery Pack Market. As renewable energy generation becomes more prevalent, the ability to store excess energy for later use is crucial. Lithium-ion batteries are increasingly utilized in energy storage systems due to their efficiency and scalability. In 2025, the energy storage market is anticipated to exceed 200 GWh, with a significant portion attributed to lithium-ion technology. This growth underscores the potential for the Lithium-ion Battery Pack Market to play a pivotal role in facilitating the integration of renewable energy into existing power grids.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are enhancing the performance and reducing the costs of lithium-ion batteries, thereby stimulating the Lithium-ion Battery Pack Market. Innovations such as solid-state batteries and improved electrode materials are expected to increase energy density and safety while decreasing production costs. In 2025, the market is projected to witness a 15% reduction in battery costs due to these advancements. As manufacturers adopt new technologies, the competitive landscape of the Lithium-ion Battery Pack Market is likely to evolve, with companies striving to offer superior products that meet the growing demands of consumers and industries alike.