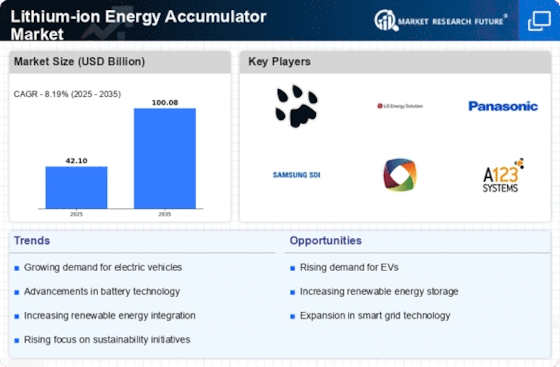

Growing Renewable Energy Sector

The increasing emphasis on renewable energy sources is a pivotal driver for the Lithium-ion Energy Accumulator Market. As nations strive to reduce carbon emissions, the integration of solar and wind energy systems has surged. Lithium-ion batteries are essential for storing energy generated from these intermittent sources, ensuring a stable power supply. In 2025, the renewable energy sector is projected to account for a substantial portion of the energy mix, with lithium-ion batteries facilitating this transition. The ability of these accumulators to provide efficient energy storage solutions positions them as a cornerstone in the renewable energy landscape, thereby propelling the Lithium-ion Energy Accumulator Market forward.

Expansion of Consumer Electronics

The proliferation of consumer electronics is a significant catalyst for the Lithium-ion Energy Accumulator Market. With the continuous advancement in technology, devices such as smartphones, laptops, and tablets are increasingly reliant on lithium-ion batteries for their power needs. In 2025, the consumer electronics sector is expected to witness a growth rate of approximately 6% annually, further driving the demand for efficient energy storage solutions. The lightweight and high energy density characteristics of lithium-ion batteries make them the preferred choice for manufacturers. This trend not only enhances the performance of consumer devices but also contributes to the overall growth of the Lithium-ion Energy Accumulator Market.

Advancements in Battery Technology

Technological innovations in battery design and manufacturing processes are driving the Lithium-ion Energy Accumulator Market. Recent advancements have led to improvements in battery life, charging speed, and safety features, making lithium-ion batteries more appealing for various applications. In 2025, the introduction of solid-state batteries is expected to revolutionize the market, offering higher energy densities and reduced risks of overheating. These advancements not only enhance the performance of lithium-ion accumulators but also expand their applicability across sectors such as automotive and renewable energy. Consequently, the Lithium-ion Energy Accumulator Market is poised for substantial growth as these technologies mature.

Rising Adoption of Electric Vehicles

The surge in electric vehicle (EV) adoption is a primary driver for the Lithium-ion Energy Accumulator Market. As consumers increasingly opt for environmentally friendly transportation options, the demand for efficient and reliable energy storage solutions has escalated. In 2025, the electric vehicle market is projected to grow significantly, with lithium-ion batteries being the preferred choice due to their high energy density and longevity. This trend is further supported by advancements in charging infrastructure and government incentives aimed at reducing carbon footprints. The growing acceptance of EVs is likely to bolster the Lithium-ion Energy Accumulator Market, creating new opportunities for manufacturers and suppliers.

Government Initiatives and Regulations

Government policies and regulations aimed at promoting clean energy technologies are instrumental in shaping the Lithium-ion Energy Accumulator Market. Many countries have implemented incentives for electric vehicle adoption and renewable energy projects, which often include the use of lithium-ion batteries. In 2025, it is anticipated that these initiatives will lead to a marked increase in the deployment of energy storage systems. The regulatory framework encourages innovation and investment in battery technology, thereby enhancing the competitiveness of the Lithium-ion Energy Accumulator Market. As governments continue to prioritize sustainability, the demand for lithium-ion accumulators is likely to escalate.