Regulatory Changes

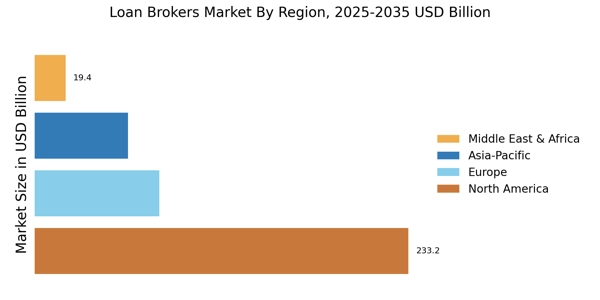

The Loan Brokers Market is significantly influenced by ongoing regulatory changes. Governments are increasingly implementing policies aimed at protecting consumers and ensuring fair lending practices. These regulations often require brokers to enhance their transparency and disclosure practices, which can lead to increased operational costs. However, compliance with these regulations can also enhance the credibility of brokers, potentially attracting more clients. For instance, recent data shows that regions with stringent lending regulations have seen a 15% increase in consumer trust towards loan brokers. As the regulatory landscape continues to evolve, brokers must remain agile to adapt to these changes while maintaining their competitive edge in the Loan Brokers Market.

Rising Consumer Awareness

The Loan Brokers Market is benefiting from a rise in consumer awareness regarding financial products. As individuals become more informed about their borrowing options, they are increasingly seeking the assistance of loan brokers to navigate the complex landscape of loans. This heightened awareness is driven by the proliferation of online resources and financial education initiatives. Recent statistics indicate that approximately 60% of consumers now research loan options before making decisions, which underscores the importance of brokers in providing expert guidance. Consequently, brokers who can effectively communicate their value proposition are likely to thrive in this evolving market. This trend suggests a promising future for the Loan Brokers Market as it aligns with the growing demand for informed financial decision-making.

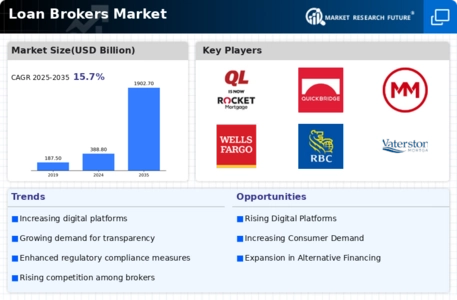

Technological Advancements

The Loan Brokers Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as artificial intelligence and machine learning are streamlining the loan application process, enhancing efficiency and accuracy. These technologies enable brokers to analyze vast amounts of data, providing tailored loan options to clients. Furthermore, the integration of digital platforms allows for real-time communication between brokers and clients, fostering a more responsive service. According to recent data, the adoption of technology in the loan brokerage sector has led to a 30% increase in customer satisfaction rates. As technology continues to evolve, it is likely that the Loan Brokers Market will further embrace these tools to improve service delivery and operational efficiency.

Economic Recovery and Growth

The Loan Brokers Market is poised for growth as economies recover and expand. With increasing consumer confidence and rising disposable incomes, more individuals and businesses are seeking loans for various purposes, including home purchases and business expansion. Recent economic indicators suggest that lending activity has increased by 20% in the past year, reflecting a robust demand for financial products. Loan brokers play a crucial role in facilitating this demand by connecting borrowers with suitable lenders. As economic conditions continue to improve, the Loan Brokers Market is likely to experience sustained growth, driven by the increasing need for financing solutions across diverse sectors.

Increasing Demand for Alternative Financing

The Loan Brokers Market is witnessing a surge in demand for alternative financing solutions. As traditional lending institutions tighten their criteria, borrowers are increasingly seeking options that offer more flexibility. This shift is particularly evident among small businesses and individuals with non-traditional credit histories. Data indicates that alternative lending has grown by approximately 25% in recent years, highlighting a significant market opportunity for brokers. By connecting clients with alternative lenders, brokers can cater to a diverse clientele, thereby expanding their market reach. This trend suggests that the Loan Brokers Market is poised for growth as it adapts to the evolving needs of borrowers seeking innovative financing solutions.