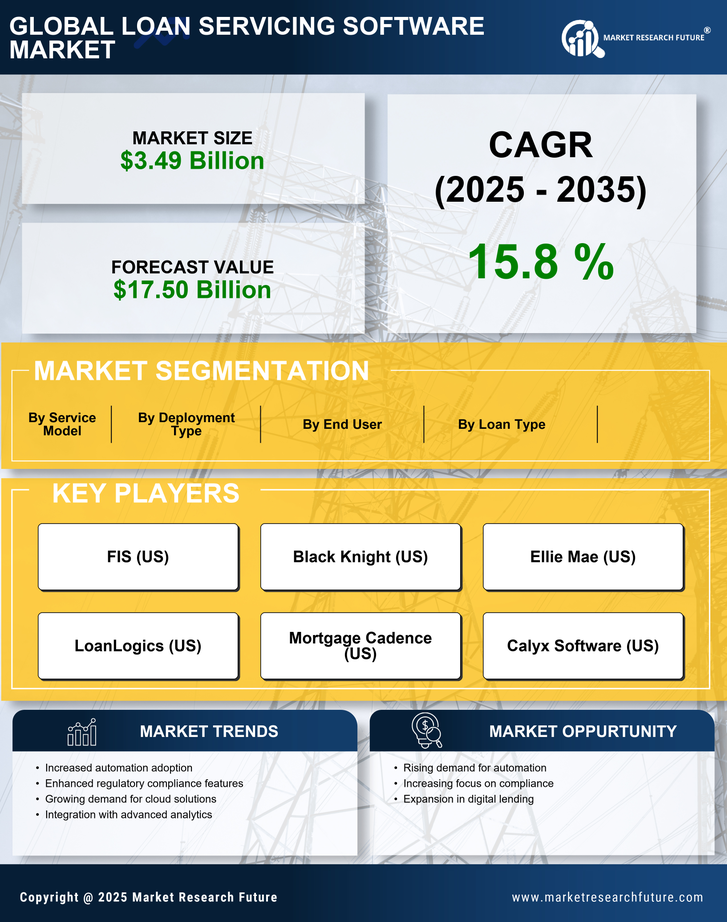

Rising Demand for Automation

The Loan Servicing Software Market experiences a notable surge in demand for automation solutions. Financial institutions are increasingly seeking to streamline their operations, reduce manual errors, and enhance efficiency. Automation in loan servicing allows for faster processing times and improved customer experiences. According to recent data, the automation segment within the loan servicing software market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This trend indicates a shift towards more sophisticated software solutions that can handle complex tasks with minimal human intervention, thereby driving the overall growth of the Loan Servicing Software Market.

Expansion of Digital Lending Platforms

The Loan Servicing Software Market is significantly influenced by the expansion of digital lending platforms. As more consumers turn to online channels for their borrowing needs, financial institutions are compelled to adapt their servicing capabilities accordingly. The digital lending market has seen a remarkable increase, with estimates indicating a growth rate of around 15% annually. This shift necessitates robust loan servicing software that can efficiently manage digital transactions, automate workflows, and ensure compliance with regulatory standards. Consequently, the rise of digital lending platforms is expected to drive innovation and investment in the Loan Servicing Software Market.

Increased Focus on Customer Experience

In the Loan Servicing Software Market, there is a growing emphasis on enhancing customer experience. Financial institutions recognize that providing a seamless and user-friendly interface is crucial for retaining clients and attracting new ones. As competition intensifies, companies are investing in software that offers personalized services, real-time updates, and easy access to information. Data suggests that organizations prioritizing customer experience in their loan servicing processes see a 20% increase in customer satisfaction ratings. This focus on customer-centric solutions is likely to propel the demand for innovative loan servicing software, thereby influencing the trajectory of the Loan Servicing Software Market.

Regulatory Changes and Compliance Requirements

The Loan Servicing Software Market is shaped by evolving regulatory changes and compliance requirements. Financial institutions must navigate a complex landscape of regulations that govern lending practices, data protection, and consumer rights. As these regulations become more stringent, the demand for loan servicing software that ensures compliance is likely to increase. Institutions are investing in solutions that provide comprehensive reporting, audit trails, and risk management features. Recent statistics indicate that compliance-related software solutions are projected to account for a significant portion of the loan servicing software market, highlighting the critical role of regulatory adherence in driving market growth.

Integration of Artificial Intelligence and Machine Learning

The Loan Servicing Software Market is witnessing a transformative shift with the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies enable loan servicing software to analyze vast amounts of data, predict borrower behavior, and automate decision-making processes. The incorporation of AI and ML is expected to enhance risk assessment, fraud detection, and customer service capabilities. Market analysis suggests that the AI-driven segment of the loan servicing software market could grow by over 20% in the coming years. This technological evolution not only improves operational efficiency but also positions financial institutions to better meet the needs of their clients, thereby influencing the overall dynamics of the Loan Servicing Software Market.