Innovative Flavor Profiles

The introduction of innovative flavor profiles is a notable driver in the Low Calorie Jelly Market. As consumer preferences evolve, there is a growing demand for unique and exotic flavors that go beyond traditional offerings. Market analysis indicates that products featuring unconventional flavors, such as tropical fruits or herbal infusions, are gaining traction among adventurous consumers. This trend encourages manufacturers to experiment with flavor combinations, thereby expanding their product lines and attracting a broader audience. Additionally, the rise of social media has amplified the visibility of these innovative products, as consumers share their experiences and recommendations online. Consequently, brands that prioritize flavor innovation are likely to enhance their market presence and appeal to a diverse consumer base.

Health-Conscious Consumption

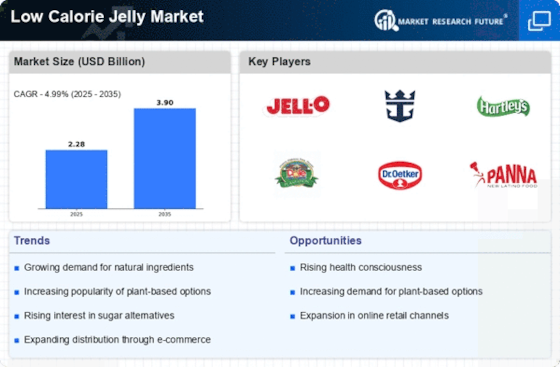

The increasing trend of health-conscious consumption is a primary driver for the Low Calorie Jelly Market. Consumers are becoming more aware of their dietary choices, leading to a surge in demand for products that align with healthier lifestyles. This shift is reflected in market data, indicating that the low-calorie segment is projected to grow at a compound annual growth rate of approximately 6% over the next five years. As individuals seek to reduce sugar intake and manage weight, low calorie jelly products are positioned as appealing alternatives to traditional sugary options. This trend is particularly pronounced among younger demographics, who are more inclined to prioritize health and wellness in their food choices. Consequently, manufacturers are innovating to create diverse flavors and formulations that cater to this growing consumer base.

Natural Ingredients Preference

The preference for natural ingredients is significantly influencing the Low Calorie Jelly Market. Consumers are increasingly scrutinizing food labels, favoring products that contain minimal artificial additives and preservatives. This trend is evident in Market Research Future, which shows that products labeled as 'natural' or 'organic' are experiencing higher sales growth compared to conventional options. As a result, manufacturers are reformulating their jelly products to incorporate natural sweeteners and fruit extracts, thereby appealing to the health-conscious consumer. This shift not only enhances the product's appeal but also aligns with broader dietary trends that emphasize clean eating. The demand for transparency in ingredient sourcing further drives this trend, compelling brands to communicate their ingredient integrity effectively.

Convenience and On-the-Go Options

The demand for convenience is a significant driver in the Low Calorie Jelly Market. As lifestyles become increasingly fast-paced, consumers are seeking quick and easy snack options that do not compromise on health. Low calorie jelly products, often available in portable packaging, cater to this need for on-the-go consumption. Market data indicates that single-serve packaging is particularly popular, as it allows for easy portion control and convenience. This trend is especially relevant among busy professionals and parents, who require snacks that are both nutritious and convenient. Manufacturers are responding by developing ready-to-eat jelly products that can be easily integrated into daily routines, thereby enhancing their appeal in a competitive market.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a crucial factor in consumer purchasing decisions, thereby impacting the Low Calorie Jelly Market. As environmental concerns rise, consumers are increasingly seeking products that utilize eco-friendly packaging and sustainable sourcing practices. Market data suggests that brands adopting sustainable practices are likely to capture a larger market share, as consumers are willing to pay a premium for environmentally responsible products. This trend is prompting manufacturers to explore biodegradable packaging options and reduce plastic usage, aligning their operations with consumer values. Furthermore, companies that actively promote their sustainability initiatives often enjoy enhanced brand loyalty and customer retention, which are vital in a competitive market landscape.