Diverse Applications Across Industries

The versatility of low carbon hydrogen is a significant driver for the Low Carbon Hydrogen Market. Hydrogen is being explored for a myriad of applications, ranging from fuel cells in transportation to feedstock in industrial processes. The transportation sector, in particular, is witnessing a shift towards hydrogen fuel cell vehicles, with projections indicating that the market for hydrogen-powered vehicles could exceed 2 million units by 2030. Additionally, industries such as steel manufacturing and chemical production are increasingly adopting hydrogen as a cleaner alternative to traditional fossil fuels. This broad spectrum of applications is likely to bolster the demand for low carbon hydrogen, thereby enhancing the industry's growth prospects.

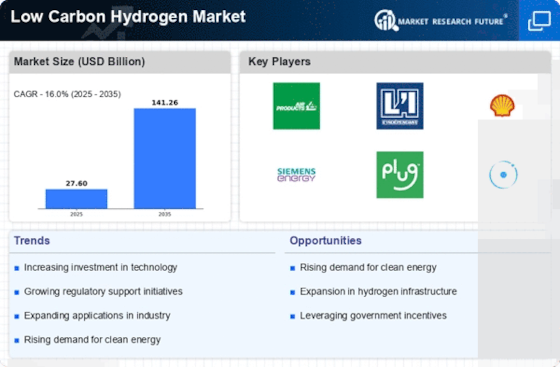

Supportive Policy Frameworks and Incentives

Supportive policy frameworks and incentives are pivotal in shaping the Low Carbon Hydrogen Market. Governments worldwide are implementing policies that promote the development and adoption of low carbon hydrogen technologies. These include tax incentives, grants, and subsidies aimed at reducing the financial barriers associated with hydrogen production and utilization. Recent initiatives, such as the establishment of hydrogen roadmaps and national strategies, indicate a concerted effort to foster a conducive environment for the growth of the hydrogen sector. Such policies not only stimulate investment but also encourage collaboration among stakeholders, thereby accelerating the transition towards a low carbon hydrogen economy.

Increasing Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is a critical driver for the Low Carbon Hydrogen Market. Governments and private entities are channeling substantial funds into the development of hydrogen refueling stations, pipelines, and storage facilities. Recent reports indicate that investments in hydrogen infrastructure could reach upwards of 100 billion dollars by 2030, reflecting a growing recognition of hydrogen's role in achieving energy transition goals. This influx of capital is likely to facilitate the scaling of hydrogen production and distribution, thereby enhancing the accessibility of low carbon hydrogen. As infrastructure expands, the Low Carbon Hydrogen Market is poised to benefit from increased adoption across various sectors, including transportation and industrial applications.

Technological Innovations in Hydrogen Production

The Low Carbon Hydrogen Market is experiencing a surge in technological innovations that enhance hydrogen production efficiency. Advancements in electrolysis, particularly proton exchange membrane (PEM) technology, have shown promise in reducing energy consumption and costs. For instance, the cost of producing green hydrogen through electrolysis has decreased significantly, with estimates suggesting a reduction of up to 30% over the past few years. Furthermore, the integration of renewable energy sources, such as wind and solar, into hydrogen production processes is becoming more prevalent. This shift not only aligns with sustainability goals but also positions the Low Carbon Hydrogen Market as a viable alternative to fossil fuels, potentially leading to a more resilient energy landscape.

Rising Environmental Concerns and Climate Commitments

The Low Carbon Hydrogen Market is significantly influenced by rising environmental concerns and international climate commitments. As nations strive to meet their carbon neutrality targets, hydrogen is increasingly viewed as a key component in decarbonizing various sectors. The commitment to reduce greenhouse gas emissions has led to a heightened focus on low carbon hydrogen as a clean energy source. For example, several countries have set ambitious targets for hydrogen production, with some aiming for a production capacity of several million tons by 2030. This growing emphasis on sustainability is likely to drive demand for low carbon hydrogen, positioning the industry as a crucial player in the global energy transition.