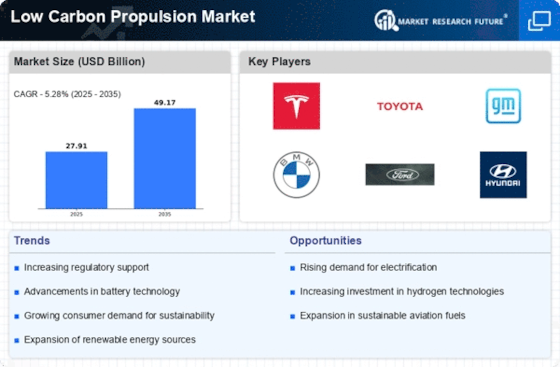

The Low Carbon Propulsion Market is currently characterized by a dynamic competitive landscape, driven by a confluence of technological advancements, regulatory pressures, and shifting consumer preferences towards sustainable mobility solutions. Major players such as Tesla (US), Toyota (JP), and General Motors (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Tesla (US) continues to innovate with its electric vehicle (EV) technology, focusing on battery efficiency and autonomous driving capabilities. Meanwhile, Toyota (JP) emphasizes hybrid technology and hydrogen fuel cells, aiming to diversify its low-carbon offerings. General Motors (US) is aggressively pursuing electrification, with a commitment to transitioning its entire fleet to electric by 2035, thereby reshaping its operational focus towards sustainable practices. Collectively, these strategies not only enhance individual company profiles but also intensify competition within the market, as firms vie for leadership in low-carbon technologies.In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize production costs. This trend is particularly evident in the automotive sector, where firms are establishing regional production facilities to cater to local markets more effectively. The competitive structure of the Low Carbon Propulsion Market appears moderately fragmented, with several key players exerting substantial influence. This fragmentation allows for a diverse range of innovations and approaches, fostering a competitive environment that encourages continuous improvement and adaptation.

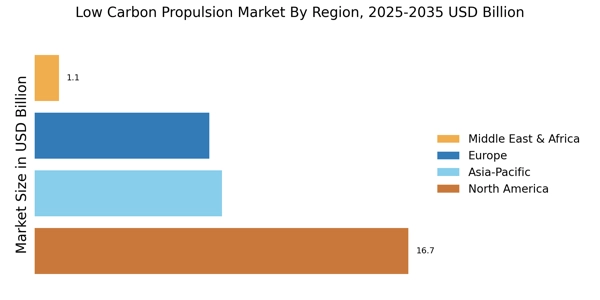

In August Tesla (US) announced the opening of a new Gigafactory in Texas, aimed at ramping up production of its next-generation battery technology. This strategic move is significant as it not only enhances Tesla's production capacity but also positions the company to meet the growing demand for electric vehicles in North America. The factory is expected to play a crucial role in Tesla's plans to reduce battery costs and improve vehicle range, thereby solidifying its competitive edge in the market.

In September Toyota (JP) unveiled its latest hydrogen fuel cell vehicle, the Mirai 2. This launch underscores Toyota's commitment to hydrogen technology as a viable alternative to battery electric vehicles. The introduction of the Mirai 2 is strategically important as it reinforces Toyota's position as a leader in hydrogen propulsion, potentially attracting consumers who are seeking sustainable options beyond traditional electric vehicles. This move may also catalyze further investments in hydrogen infrastructure, enhancing the overall market landscape.

In October General Motors (US) revealed a partnership with a leading tech firm to develop advanced AI systems for its electric vehicles. This collaboration aims to integrate AI-driven features that enhance user experience and vehicle performance. The strategic importance of this partnership lies in its potential to differentiate GM's offerings in a crowded market, as consumers increasingly seek vehicles that offer not only sustainability but also cutting-edge technology.

As of October the competitive trends within the Low Carbon Propulsion Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming pivotal, as companies recognize the need to collaborate to accelerate innovation and enhance supply chain resilience. Looking ahead, it is likely that competitive differentiation will evolve from traditional price-based competition to a focus on technological innovation, sustainability, and reliability in supply chains. This shift may redefine market dynamics, compelling companies to invest in R&D and forge strategic partnerships to maintain their competitive advantage.

.png)