Growth in Renewable Energy Sources

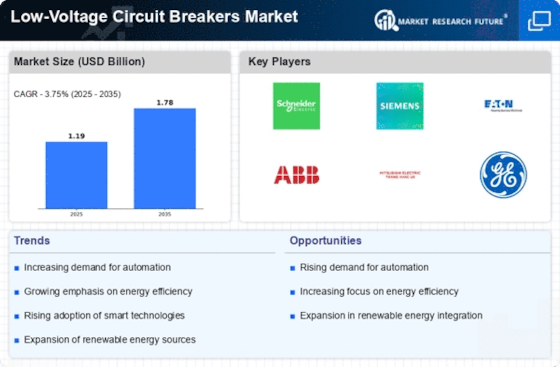

The transition towards renewable energy sources is significantly influencing the Low-Voltage Circuit Breakers Market. As solar, wind, and other renewable energy technologies gain traction, the need for reliable and efficient circuit protection becomes paramount. Data indicates that the renewable energy sector is expected to grow at a compound annual growth rate of over 8% in the coming years. This growth necessitates the deployment of low-voltage circuit breakers that can handle the unique characteristics of renewable energy systems, such as variable loads and intermittent power supply. Furthermore, the integration of these energy sources into existing grids requires advanced circuit protection solutions to ensure safety and reliability, thereby driving market expansion.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency is a pivotal driver for the Low-Voltage Circuit Breakers Market. As industries and consumers alike seek to reduce energy consumption, the demand for advanced circuit breakers that minimize energy loss is surging. According to recent data, energy-efficient electrical systems can reduce energy costs by up to 30%. This trend is particularly pronounced in commercial and industrial sectors, where operational costs are closely monitored. Consequently, manufacturers are innovating to produce low-voltage circuit breakers that not only comply with energy standards but also enhance overall system performance. The integration of smart technologies further amplifies this demand, as these devices can optimize energy usage in real-time, thereby contributing to a more sustainable energy landscape.

Increased Infrastructure Development

The ongoing infrastructure development across various regions is a crucial driver for the Low-Voltage Circuit Breakers Market. Governments and private sectors are investing heavily in modernizing electrical infrastructure to support urbanization and industrial growth. Reports suggest that infrastructure spending is projected to reach trillions of dollars in the next decade, creating a substantial demand for low-voltage circuit breakers. These devices are essential for ensuring the safety and reliability of electrical systems in new constructions, including residential, commercial, and industrial buildings. As infrastructure projects proliferate, the need for advanced circuit protection solutions that can accommodate higher loads and enhance system resilience becomes increasingly critical.

Regulatory Compliance and Safety Standards

The stringent regulatory compliance and safety standards are a driving force in the Low-Voltage Circuit Breakers Market. Governments and regulatory bodies are implementing rigorous safety standards to protect consumers and ensure the reliability of electrical systems. Compliance with these regulations is not optional; it is a necessity for manufacturers aiming to maintain market access. Data shows that the market for low-voltage circuit breakers is expanding as companies invest in products that meet or exceed these safety requirements. This trend is particularly evident in sectors such as construction and manufacturing, where adherence to safety standards is critical. As regulations evolve, the demand for compliant circuit protection solutions is likely to grow, further propelling market dynamics.

Technological Innovations in Circuit Protection

Technological advancements in circuit protection are reshaping the Low-Voltage Circuit Breakers Market. Innovations such as digital circuit breakers and smart grid technologies are enhancing the functionality and efficiency of circuit protection devices. These modern solutions offer features like remote monitoring, automated fault detection, and improved response times, which are becoming essential in contemporary electrical systems. Market data indicates that the adoption of smart circuit breakers is expected to increase significantly, driven by the growing demand for automation and control in electrical networks. As technology continues to evolve, manufacturers are compelled to innovate, ensuring that their products meet the changing needs of consumers and regulatory standards.