Increased Focus on Safety Standards

The molded case-circuit-breakers market is experiencing a heightened focus on safety standards, which is driving demand for high-quality circuit protection devices. Regulatory bodies in the US are continuously updating safety regulations to ensure that electrical systems meet stringent performance criteria. This emphasis on safety is particularly relevant in sectors such as construction, manufacturing, and energy, where the risk of electrical hazards is significant. As a result, manufacturers are compelled to enhance the safety features of their molded case-circuit-breakers to comply with evolving standards. The market is likely to see an increase in certifications and testing requirements, which could lead to a consolidation of suppliers who can meet these rigorous demands. This trend not only enhances the reliability of electrical systems but also positions the molded case-circuit-breakers market for sustained growth as safety becomes a paramount concern.

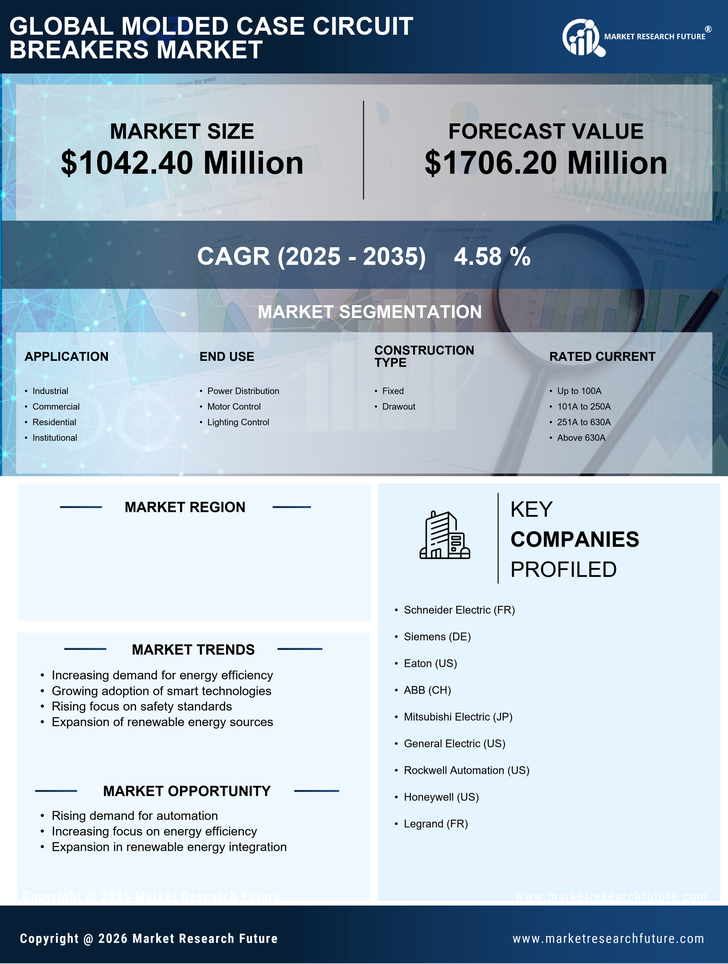

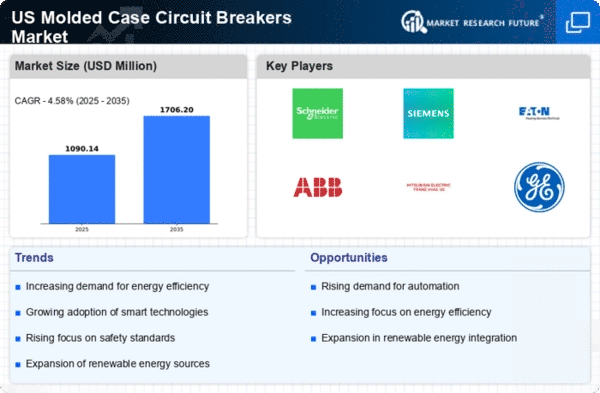

Rising Demand for Energy Efficiency

The molded case-circuit-breakers market is experiencing a notable surge in demand driven by the increasing emphasis on energy efficiency across various sectors. As industries strive to reduce operational costs and enhance sustainability, the adoption of energy-efficient electrical components becomes paramount. This trend is particularly evident in commercial and industrial applications, where energy consumption constitutes a significant portion of operational expenses. According to recent data, the energy efficiency market in the US is projected to grow at a CAGR of approximately 8% through 2027. Consequently, manufacturers of molded case-circuit-breakers are innovating to meet these demands, integrating advanced technologies that optimize energy usage while ensuring safety and reliability. This shift not only supports regulatory compliance but also aligns with the broader goals of reducing carbon footprints, thereby propelling the molded case-circuit-breakers market forward.

Expansion of Renewable Energy Sources

The molded case-circuit-breakers market is poised for growth as the expansion of renewable energy sources gains momentum in the US. With a significant push towards solar, wind, and other renewable energy technologies, the need for reliable electrical protection devices becomes increasingly critical. Molded case-circuit-breakers play a vital role in safeguarding electrical systems from overloads and short circuits, particularly in renewable energy installations. The US Department of Energy has reported that renewable energy sources accounted for approximately 20% of the total electricity generation in 2025, a figure that is expected to rise. This transition necessitates the integration of advanced circuit protection solutions, thereby driving demand for molded case-circuit-breakers. As the energy landscape evolves, the molded case-circuit-breakers market is likely to benefit from this shift towards cleaner energy alternatives.

Technological Innovations in Circuit Protection

Technological innovations are reshaping the molded case-circuit-breakers market, as manufacturers increasingly focus on developing advanced circuit protection solutions. Innovations such as smart circuit breakers, which offer enhanced monitoring and control capabilities, are gaining traction in the market. These devices not only provide traditional protection against overloads and short circuits but also integrate with smart grid technologies, enabling real-time data analysis and remote management. The US market is witnessing a shift towards digitalization in electrical systems, with smart technologies projected to account for a substantial share of the molded case-circuit-breakers market by 2030. This trend suggests that manufacturers who invest in research and development to create innovative products will likely capture a larger market share, thereby driving overall growth in the industry.

Growth in Construction and Infrastructure Development

The molded case-circuit-breakers market is significantly influenced by the ongoing growth in construction and infrastructure development across the US. As urbanization accelerates and infrastructure projects expand, the demand for reliable electrical systems increases correspondingly. The construction sector is projected to witness a growth rate of approximately 5% annually, leading to heightened requirements for electrical safety devices, including molded case-circuit-breakers. These devices are essential for protecting electrical circuits in residential, commercial, and industrial buildings. Furthermore, the US government has initiated various infrastructure programs aimed at modernizing existing facilities, which further stimulates the molded case-circuit-breakers market. This growth trajectory indicates a robust future for manufacturers and suppliers within the industry, as they adapt to the evolving needs of the construction landscape.